This article is another of my “Here is the math behind a scam” nerd hit pieces. I don’t mean to knock any of the people doing these things. We are all trying to do our job. I bought crypto too. Everyone wants to get rich. Some people are better at selling risky Ponzi schemes using the shared language of trust than others. I'm Owen;

I’m a doctor.

I write this newsletter:

We Have an Investment Opportunity for You, Said Private Equity Underpants Gnomes

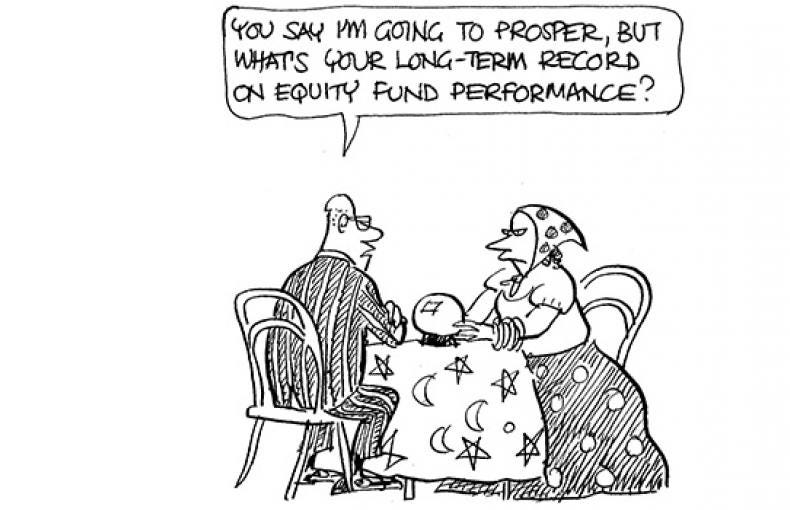

Private Equity (PE) firms are con men. I mean this literally—not as an insult. Their job is, first and foremost, to get Limited Partners1 to hand them money—this requires instilling confidence. That is where the “con” in “con men” comes from.

The best summary of this comes from the South Park episode on “corporate takeovers:”

This is the math behind why the above video is satire, as it relates to the corporate takeover of healthcare.

The business model is like the underpants gnomes2:

Step 1: steal underpants.

Step 2.:?

Step 3: profits.

The underpants gnomes episode is making fun of dubious business plans. But here are some edits to make them reputable PE fund managers:

Step 1: Steal the autonomy of healthcare professionals3

Step 2: “Promise returns”—every dollar they “invest” to obtain control of the healthcare setting is money they are “managing”…this means their incentive is to pay more, not less, to buy control. Add debt leveraging.4

If they have an “exit,”—they sell the “investment,” aka healthcare group, to the highest bidder, again with none of their money on the line, they get 20% of the profits.

Step 3: Profits…Minus 20%!

They get to keep 2% per year of the funds under management. They also get 20% of any profits. That is the standard deal. They are under no obligation or risk financially. They get 2% if it goes well or if they lose it all5. This is a terrible plan. Let me show you.

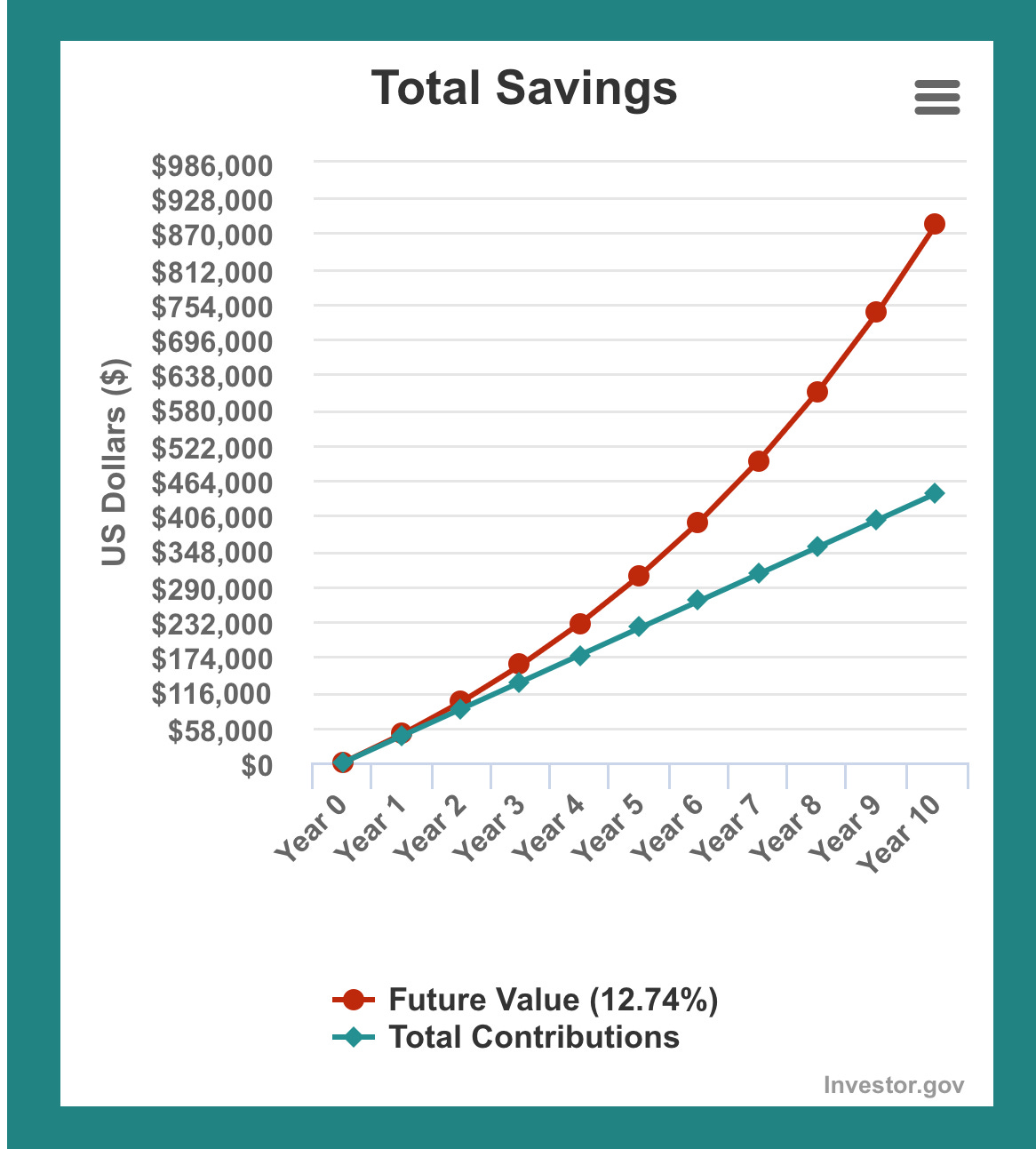

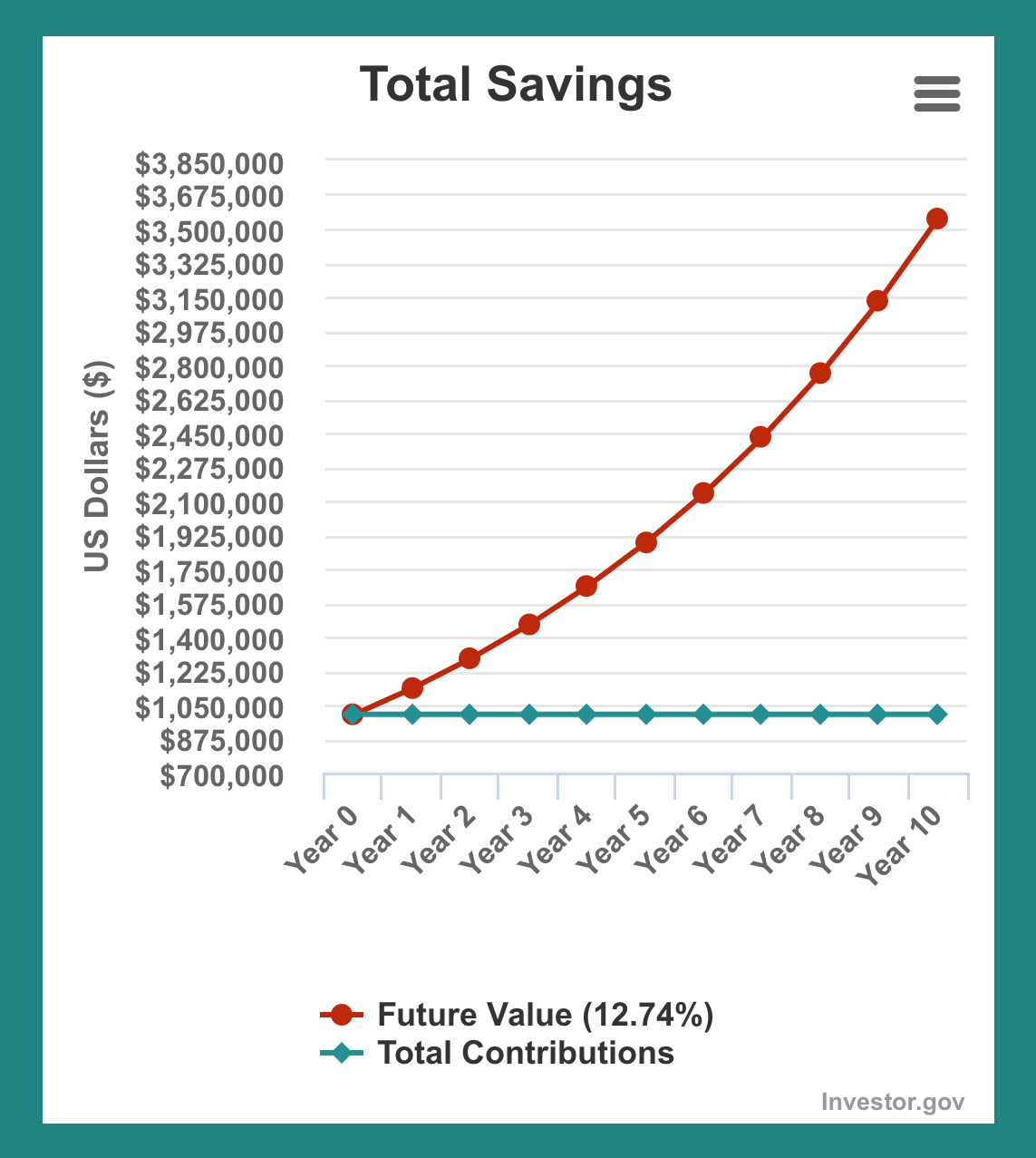

Fees kill growth, don’t you know? Paying 2% annually to someone else to “manage your money” is terrible unless they promise to do so much better that they are worth it. Here are the average stock market returns:

40 Years (1982 – 2022): 11.6% annual return

30 Years (1992 – 2022): 9.64% annual return

20 Years (2002 – 2022): 8.14% annual return

10 Years (2012 – 2022): 12.74% annual return

Remember—that rate compounds so that changes can have a big impact! We will start with $1,000,000 in investment capital. If you just bought an S+P 500 index fund:

Your fund would be up by $3.65m in ten years.

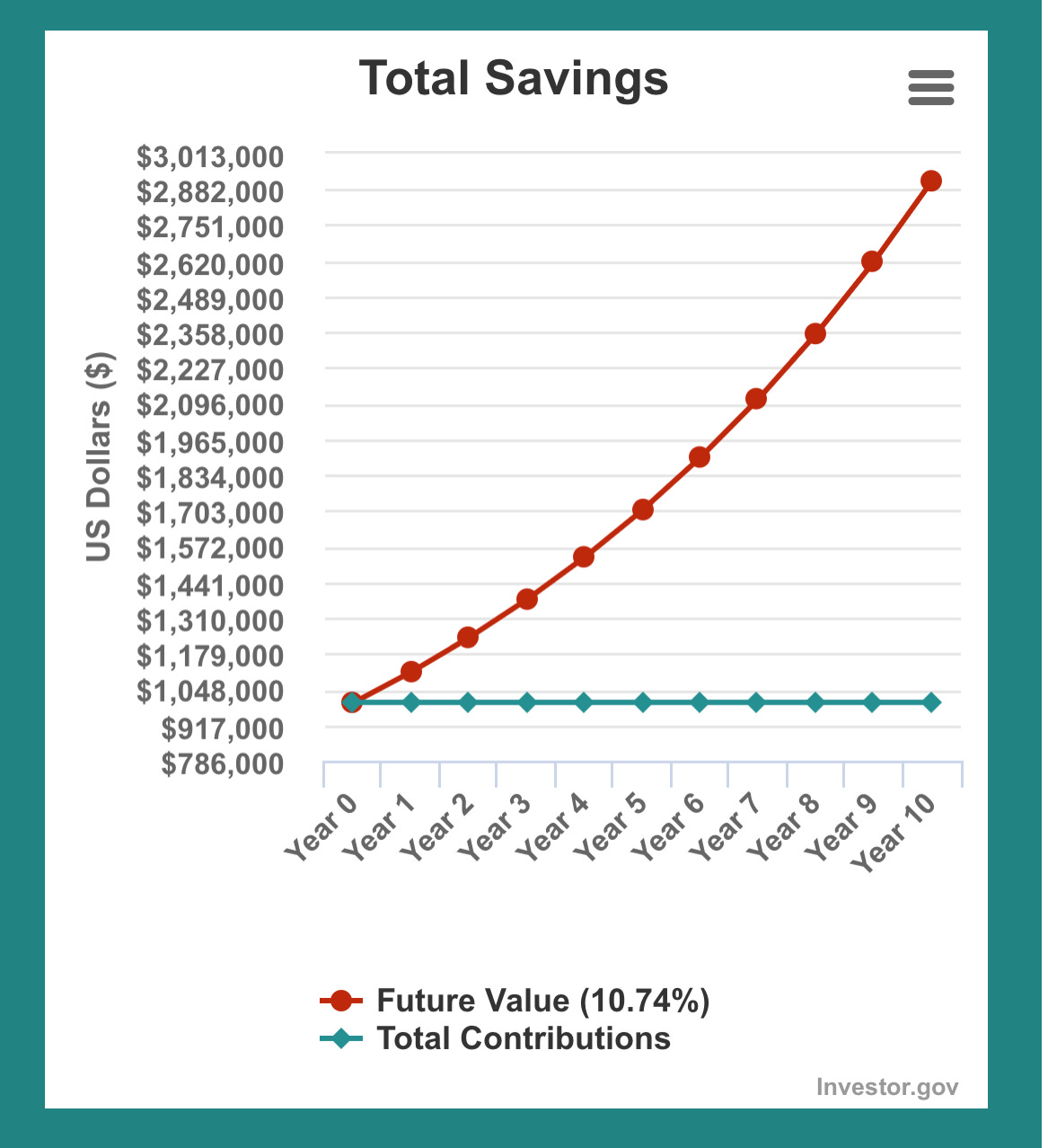

If you paid someone 2% to tell you to do that but incurred no additional costs or risk:

Your fund would only grow by $2.8m.

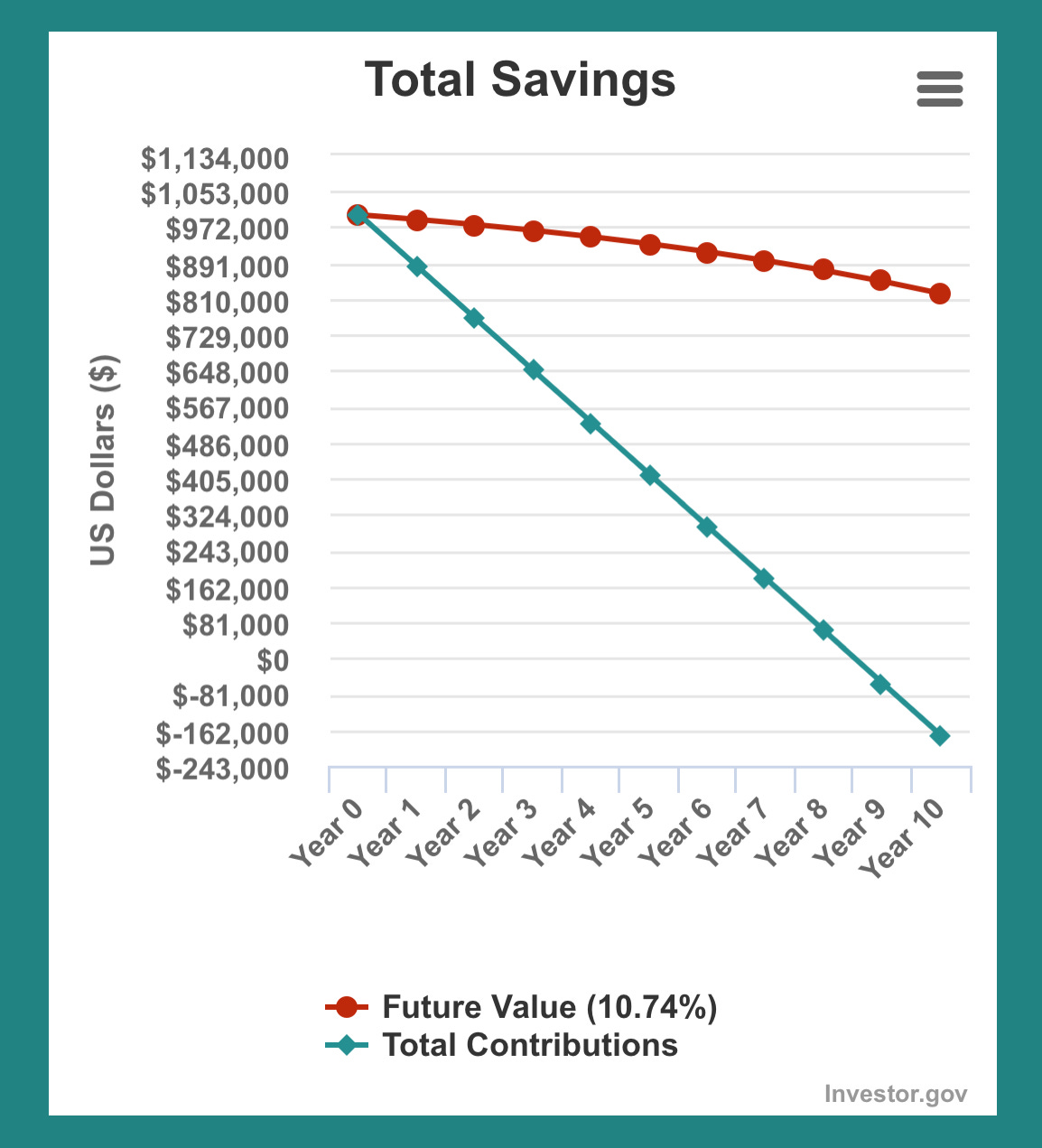

If you handed the million to PE guys in very reassuring suits and they used leverage—borrowing money with your money—this is what it costs to pay back an 8% loan every month, plus the above compounding:

Oh my. Now, your million is down by almost $200,000! That is assuming no catastrophic loss. Wait a minute; they must take their 20% when the above investment exits…so you get:

$712,000 total back. On your million-dollar investment ten years ago. The PE guys would walk away from that underwhelming performance…assuming they invested it in an index fund…

That is with an example of a “successful exit!”… They made more than your fund. The pension fund got less than they would have made had they invested in the stock market's average return by…

-$2.269m.

In fairness, the PE firm walked away with $1.16m they would not have had otherwise.

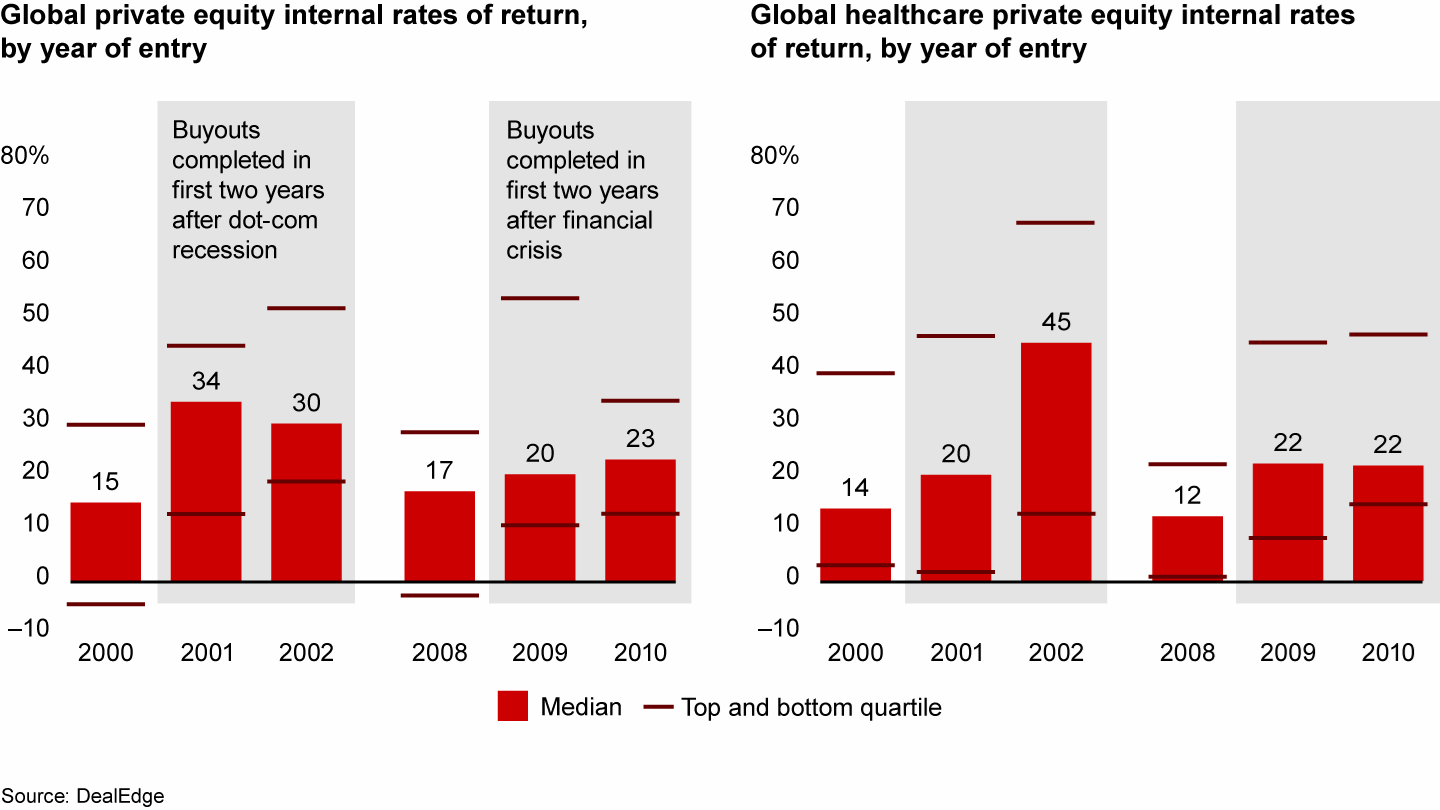

The rates of return depend on the top and bottom quartile and luck. The median returns— minus the fees, minus 20% — are worse than the stock market6. Using debt to “leverage” the deals increases the risks to the acquired entities and the Limited Partners of the investors. It does not increase the risk to the PE “investors,” who are underpants gnomes. They are selling the ability to gamble on it being a good year with good exits at higher risk…and instilling confidence that this is a good idea.

The trick—for any investor— is that you don't know if it’s a top or bottom-quartile investment. You have to have confidence that it’s worth it…given the debt leveraging making successful exits less likely and the costs of fees dragging the enterprise down as outlined above.

Keep in mind, the percentage of time Healthcare PE deals lose ALL the money for their investors7 is on the order of 22%. And a healthcare “deal going south” takes an investable healthcare business…and runs it into the ground, so it has to be closed. The risk is to the system, the doctors, the patients, and the investors, who are also…the patients who have pension fund money being “invested” by high-risk gamblers at no risk to themselves.

My fake firm, Corner-Bet Health Partners, which puts LP money on the roulette wheel in exchange for 1% carry and 10% of profits, is starting to look pretty good…Roulette players have elaborate strategies to justify their gameplay:

The Martingale System

The concept behind the strategy is quite simple – you increase your bets after every loss, so when you eventually win, you get your lost money back. After this, you start betting with the initial amount again.

The most effective way to use the Martingale system is to only bet on even-money outside bets – 1-18, 19-36, Red, Black, Even, and Odd. The outside bets in Roulette have almost 50% chance of winning, but they offer the lowest payout of all – 1:1. This means that you win the same amount of money you bet for the spin.The Martingale is rather risky, and you’re essentially betting big to win small. And there is a risk of losing a huge amount of money while using this system.

Corner Bet Partners, assuming it was a “top-quartile” in luck, with lower fees…well, here is the math on how that strategy does8:

The Wizard of Omaha Dissents

Warren Buffett once took a 10-year bet on this very topic against hedge funds and won. And hedgies and their quants are probably smarter-ish than Private Equity guys…and they are mostly guys.

In 2008, Warren Buffett issued a challenge to the hedge fund industry, which in his view charged exorbitant fees that the funds' performances couldn't justify. Protégé Partners LLC accepted, and the two parties placed a million-dollar bet.

Buffett has won the bet, Ted Seides wrote in a Bloomberg op-ed in May. The Protégé co-founder, who left in the fund in 2015, conceded defeat ahead of the contest's scheduled wrap-up on December 31, 2017, writing, "for all intents and purposes, the game is over. I lost."

Buffett's ultimately successful contention was that, including fees, costs and expenses, an S&P 500 index fund would outperform a hand-picked portfolio of hedge funds over 10 years. The bet pit two basic investing philosophies against each other: passive and active investing.

Private Equity’s job is to take 2% of your “assets under management”—the carry—and keep it for themselves. And keep you CON-fident that they will do a good job.

As previously reviewed, the absolute top-performing health unicorns as late-stage companies exit at just under 7x their total invested capital. Assuming the PE firms in health invest with the same outcomes as only the best of the VC-backed health unicorns and fail completely at the same rate as real PE healthcare investments, the math goes as follows, per million invested over ten years…with help from Bard (split up into $100,000 bets over ten years per million with debt leveraging9):

The PE chaps then take a bet—with pensioner’s money—and call it an investment.

You will notice something is missing…downside risk for the gamblers, sorry, private equity investors. And the doctors and patients who are also pensioners, in the best case scenario, health care practices and roll-ups are now run by business people, not doctors. They can’t even roll up an entire medical discipline and run it profitably without causing the specialty and the firms' collapse!

Meanwhile, they bought 51% of the practice for 10m and “invested” whatever they wanted, diluting the owners with their own funding to help it “scale.” They “help” by negotiating better contracts than physicians… to sell to United, Cigna, or CVS. Will United pay more to the company it will later acquire using its increased revenue to justify the acquisition costs while increasing the cost of care for its services business and thus increasing its share of the medical loss ratio on both sides of the ledger? Yes, yes, it will. The physician owner works for five years, gets bought out, and keeps as little as is mathematically possible at the end.

The PE “investors” have instilled confidence. And what they did with that was take pension fund money, destroy 22% of the companies they acquired, drop billions of surprise bills on the very pensioners’ whose retirement saving they were entrusted with deploying, burn out, and rob a bunch of doctors, and leave the party very, very wealthy indeed. The rest of us are sick, debt-burdened, or dead. We wish we had just had our blood sucked by old-fashioned vampires.

This is a bad system. “Business People” in the form of PE investors are NOT SMARTER OR BETTER AT RUNNING HEALTHCARE. Not financially, not for outcomes, not any of it. They are better at acting CONFIDENT. This is the very definition of a con job. They make you confident and walk away with money no matter what, and the rest of us take all the risk.

Then again, I’m just a doctor. I never got an MBA or anything. I just watched American Healthcare go to utter $*%^# all around me…

On the upside, when you do a Google image search for “Private Equity Healthcare Vampire, " this comes up first, so who is winning now?

THIS Satire journalist— that is who.

For reference, to check my provocative math, see the calculations below.

Below is the Python code for Corner Bet Partner’s winning investment hypothesis that outperforms PE but also DOES NOT INCREASE THE COST OF HEALTH CARE or DESTROY 22% OF HEALTHCARE BUSINESSES THAT PERFORMED WELL ENOUGH THEY GARNERED INVESTMENT CAPITAL.

import random

def simulate_year(chance_of_winning, rake, winnings_extraction):

"""Simulates one year of the private equity firm.

Args:

chance_of_winning: The probability of winning a bet.

rake: The percentage of the bet that is taken as rake.

winnings_extraction: The percentage of winnings that is extracted by the firm.

Returns:

The amount of money the firm has at the end of the year.

"""

balance = 100000

for _ in range(12):

bet = 1000

if random.random() < chance_of_winning:

winnings = bet * 8

winnings -= winnings * rake

winnings -= winnings * winnings_extraction

else:

winnings = 0

balance += winnings

return balance

def simulate_10_years(chance_of_winning, rake, winnings_extraction):

"""Simulates 10 years of the private equity firm.

Args:

chance_of_winning: The probability of winning a bet.

rake: The percentage of the bet that is taken as rake.

winnings_extraction: The percentage of winnings that is extracted by the firm.

Returns:

The amount of money the firm has at the end of 10 years.

"""

total_money = 0

for _ in range(10):

total_money += simulate_year(chance_of_winning, rake, winnings_extraction)

return total_money

def main():

"""Runs the simulation 100 times and prints the results."""

results = []

for _ in range(100):

results.append(simulate_10_years(0.5, 0.02, 0.2))

results.sort(reverse=True)

print("The top quartile results are:")

for result in results[:25]:

print(result)

if __name__ == "__main__":

main()investors who don’t get to say what they do with the money

but with the profits for them worked out

using a pool of money from pensioners and borrowing money for “leverage” —aka debt financing that gets put on the books of the acquired entities- is a problem when interest rates rise.

They get 2% per year from the funds they manage for the privilege of having them do this. It also carried interest, which isn’t legally taxed as income. They still get to keep it.

Not their money.

in a bad year

while keeping fees

sigh.

Featuring BARD—with some editing by me cause it’s a terrible writer, per million: Here are the results of the simulation with the 2% rake and 22% failure rate, but with each deal underwritten with debt at an additional 5% rate, compounded monthly, on 1,000,0000 additional dollars borrowed with the initial million invested, and double bet sizes:

The top quartile results are:

308418.87

298284.89

292602.55

291805.95

291019.35

290065.54

288067.47

287145.64

286557.45

286185.60

As you can see, the top quartile of the simulations resulted in an expected return of at least $308,000. This is significantly higher than the expected return of $78,000 without the debt, which means the private equity firm has a much higher chance of success.

The total output after ten years is $3,084,188.77*. This is the maximum output of the simulation, meaning the private equity firm can earn this much money in 10 years. However, it is important to note that this is just one possible outcome, and the actual output of the firm will vary depending on the random bets.

The average output of the simulation is $232,000. This means that if the private equity firm were to run the simulation 100 times, it would expect to earn an average of $232,000 per simulation.

The bottom quartile of the simulation results in an output of less than $250,000. This means there is a lower chance that the private equity firm will not succeed. However, the top quartile of the simulation results in an output of over $308,000 per 100,000 investment.

*Remember, you could have just invested in the S+P 500 with that million upfront and…earned $3.65m.

Thanks for the reshare. The painstaking math genre is really ready for it's spotlight