The Passion of the Medical Loss Ratio

The complete saga, resurrected.

The Frontier Psychiatrists is a daily health-themed newsletter. The following article combines two previous articles with some edits for clarity and to make myself just a touch less glib. However, I will also note, dear readers: I suspect this series of articles did a non-trivial amount to allow national coverage policy changes for OCD treatment. I wrote these two articles…and my readers include influential people, unlike myself. Except—here is the influencer trick—if you can influence someone to change their mind, and they can, themselves, influence change, you have successfully become a meta-influencer. So while you are reading today, 2+ years after these first hit the internet, it’s worth thinking to yourself…who would pay attention to this? The answer is healthcare administrators—with vision! Without further delay, “The Passion of the Medical Loss Ratio”…

The Christian tradition talks about the concept of “original sin.” This becomes the basis for why our Western tradition’s leading man—Jesus— had to die. He had to die in a dramatic way for the story to have real forward momentum.

As scholars of the biblical story of Jesus, some have chosen to focus on the suffering he endured in the peri-crucifixion period. The psychological pain— how much it would suck to know one was forsaken by God when he’s your dad—was understood as the bad part. Others focused on a more corporeal “snuff porn” take on His crucifixion. Both groups agree this experience—“The Passion”— sucked. Jesus —in some version of “33 AD’s SAW prequel”— died for our sins. On a cross. In misery. Plenty suffer, but Jesus knew he was the son of God. So why was God not bailing him out? This psychological horror—God should be stopping this any minute now. That is the Passion. It’s pain plus the knowledge that you have been abandoned to that pain, despite knowing for damn sure God is your dad.

And Lo, with this sacrifice, our sins were thusly forgiven. Not ones to waste a “safe harbor” loophole, healthcare regulators and politicians have replicated this “thou art forsaken” experience with a growth trajectory the envy of every YC grad.

Crucifixion is a grim business. It reminded the enemies of Rome of the price of disobedience. Even the involuntary schlepping of the horizontal beam of a cross on one’s way to one’s execution was the “co-insurance” of the day. The almost-crucified were expected to bear the burden and spare the Centurions. But there’s an important point about crucifixion, which makes it a palatable option when compared to the suffering of “the patient journey” in psychiatric illness: the crucified knows the suffering will end. It’ll be a couple of days, and then …you will not have to feel that way anymore—predictably. It is not that death is a good outcome for the crucified, but you generally had a good sense of where things were going and the intent of the parties involved. As Shakespeare notes In Macbeth (Act I, Scene II):

If I say sooth, I must report they were

As cannons overcharged with double cracks, so they

Doubly redoubled strokes upon the foe:

Except they meant to bathe in reeking wounds,

Or memorize another Golgotha,

I cannot tell.

But I am faint, my gashes cry for help.

This is, of course, an allusion, in the beginning of the play to the place—Golgotha—where Jesus was crucified. Even in one of the bloodier Shakespearean tragedies, this is not understood as a scene to re-create.

However, ignoring the lessons of history is as reliable as playwrights cautioning against it. In our modern health care system, we have added the indignity of getting snail-mailed a bizarre parody of a bill called an Explanation of Benefits (EOB) at the end. To wit:

Explanation of Crucifixion: (EOC)

The Following is Not a Bill

Crucifix Procedural Terminology (CPT) Code: C666

Dx Code: M33.2 (Messianic Personality Disorder)

Place of service: Golgotha

Billed amount: 100 silver.

Allowed amount: 50 silver.

20% Co-insurance: 10 silver.

Your plan rendered: 40 silver.

You may still render unto Caesar: 50 silver.

And you thought The Passion was bad? Imagine going through hell and back—literally—and this is in your papyrus inbox! I would also like to get credit for citing Macbeth in two separate mental health think pieces!

To suffer in silence or, worse, loudly but unheaded is tragic. To be denied care that might be helpful when in the pit of despair? This is The Passion of the psychiatrically suffering. I’m presenting the hypothesis that people are forsaken because…it makes a complex balance sheet work. It is a trespass against us. The experience of care for under-treated depression or misdiagnosed schizophrenia is horrifying. The fee-for-service insurance system is a system of unoriginal sin — in our case, it’s a cynical implementation of an attempt to limit the optics of profits. This is done with centurion-stoic disregard for unintended consequences. The business model profits from suffering. This would predict “more suffering.” And it does. And we do.

Now, if you were thinking: “Dr. Muir is a little messianic” with this glib comparison of psychiatric care and crucifixion of the Lord Christ, consider: The crucified were often stabbed or had their limbs broken to hasten their painful death …as a service. That mercy—harsh though it may have been— is only a fantasy for those suffering under the current standards of care. 45,000 people kill themselves every year in the US because they would, in a dark enough moment, rather die than live as their illness dictates. In Rome, the passing throngs of citizens mercy killed people left to die by asphyxiation. Yep. It is with a grim sense of irony I note that this is still a common way for vulnerable people—often mentally ill—to die at the hands of the state. In the US, instead of help, we trust those in despair to just kill themselves already. For scale, the number of completed suicides annually is more every single year than we’ve ever had in a research study on suicide or depression.

Jesus had to wonder why he was forsaken. Those suffering now get that answered for them every time they seek care. They are “not a good fit for the practice.” Our cruel Caesar? I am speaking, of course, of the Medical Loss Ratio (MLR) for private health insurance.

Even that name probably tells regular folks nothing about what I’m talking about, and that’s kind of the point. It is so boring you might have already had a false positive on a sleep latency test just by reading those words. Try it: Medical Loss Ratio. Medical Loss Rat-snooooore. It’s like counting sheep.

And yet, I will argue that the incentives created by this system lead to the prolonged and predictable suffering of millions. Decades of despair, overdose, and death are its due. The MLR insures—get it?!— suffering on a scale that would make Rome’s Professional Crucifiers Association blush.

To make this less boring, I’m going to use a metaphor. To avoid being cool, I will use a really dad one. It also lightens this article up quite a bit, which, after opening with Mel Gibson’s torture porn obsession, is a welcome palate-cleansing sorbet. Or, in this example, ice cream:

The Passion (Fruit Scoop) of the Ice Cream Serving Size

I have twin six-year-olds. If there was a regulation around how much ice cream they could consume, and it followed the same math as the MLR, this would be a Sunday conversation with my kiddos:

“Trent, Quinn, come here. It’s time to have some ice cream. All of the adults have had a conversation, and we’ve decided it would be inappropriate for you to have the appearance of too much ice cream. So daddy has a rule—Quinn, put that spoon down— about the amount of ice cream you can have.

“You can’t stop us from eating as much ice cream as we want!”— Trent, lobbying effectively.

“You are correct, young man. Practically speaking, I can neither limit the amount of ice cream you’re going to want nor can I keep you away from eating as much ice cream as you’re going to. I mean, I could. That would be good parenting. I could make adult rules for the total amount of ice cream, or create other regulatory standards. But I’m not gonna do that. Because I don’t want to hear you complain, or in grown-up language, lobby. What I can do is cynically control for other people thinking I’m a terrible father. So I’m going to limit both of you could be eating…only 20% of the ice cream in your bowl.“

“But how much total ice cream can we have that fractional amount of?“ Quinn asks, with frankly, disturbingly mature verbiage.

“So that’s the thing, you can ask for any total amount of ice cream you’d like. In fact you can ask for incrementally more ice cream every time. Every bowl can have as much as ice cream as you can spoon out. But you can only complete 20% of any given bowl.”

“Is there any limit on total number of bowls?” asks Trent, with growing suspicion. After all, we had the “things that are too good to be true” talk just last week!

“There will not be any limit on number bowls. This is America!” I respond, patriotically.

My children work out that asking for more ice cream is THE correct answer to allow maximal gorging on 20% of that amount.

“Maybe keep in mind how permissive I am now when you are choosing old folks homes one day?” I mutter.

“That would be undue influence!” says Trent, who clearly has been learning to read at a pace that I have not understood until just now.

I trust this is likely to be both the first and, God willing, the last time that twin 6-year-olds were used to explain the medical loss ratio.

In their childish innocence, they highlight the fundamental problem: if you can only ever make a 20% profit margin and still want to increase profits, you need to increase both premium costs and what you spend on care. Or, as Trent later put it,… “Daddy… My tummy hurts… But can I have some more? If I have some of your Pepto-Bismol daddy, I can accomplish a little bit more ice cream eating!”

Kids, at least those who are being scripted by their physician parent with a healthcare economics axe to grind, say the darnedest things!

Let’s Play Pretend!

Blue Cross, United, Cigna, Aetna (BUCA for short), Anthem, Magellan, Oscar, Elevance, Evernorth, Optimus Prime—and other carrier names following that pattern? They pretend to want to save money all day long. The fiction of “controlling costs” never gets old. This is why, we are told, care must be denied. There may be some market segments where it makes sense to save. But overall, any contention that reducing cost is what will happen is fictional at best and fraudulent at worst.

Prior Authorization?

It exists to increase total cost by kicking cans down the road till people are sicker—sick enough to need the really expensive care!

The Worst Shareholder Meeting Ever Imagined (BUCA edition)

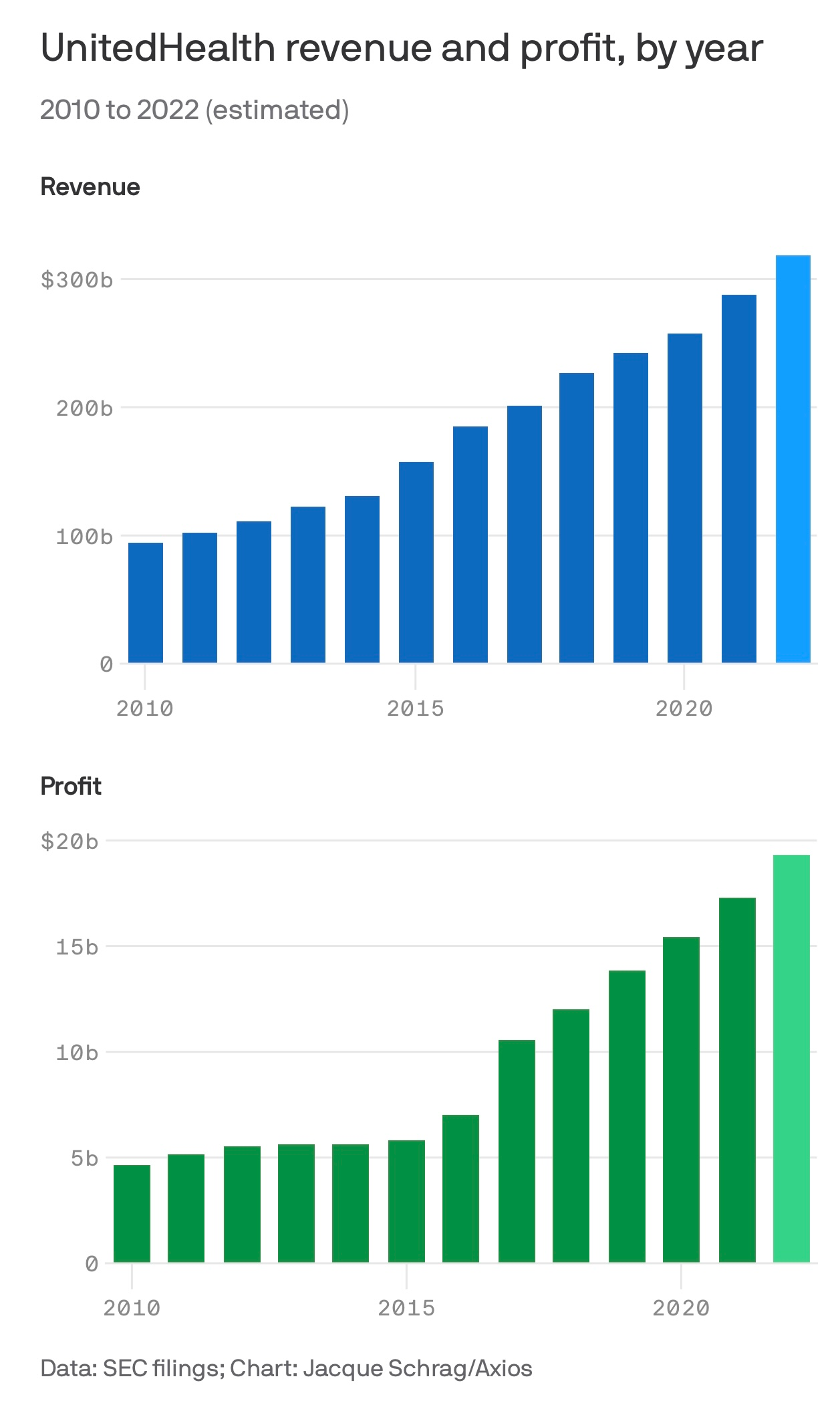

Dear shareholders—amazing news: we cut costs by 7%. Please enjoy our 20% profit margin of 7% less spending. Remember that a 1% drop in the share price of UHC erases the order of $4.5b from shareholder accounts. That is more than the market cap of any two startup unicorns below #15 on the top 100 list combined.

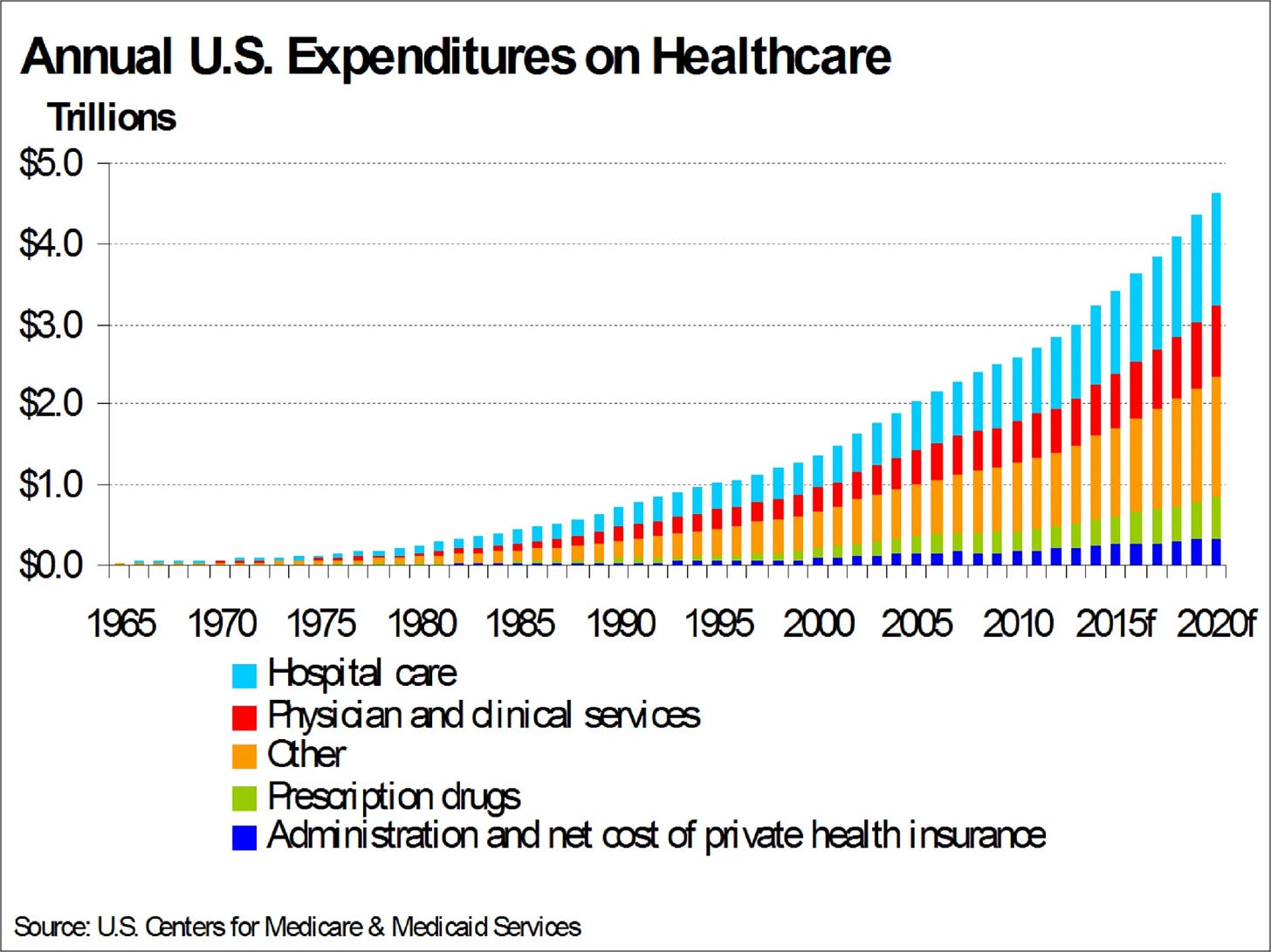

More spending on healthcare is simple. More sickness has to be treated with more care …expensively. This is the familiar trend:

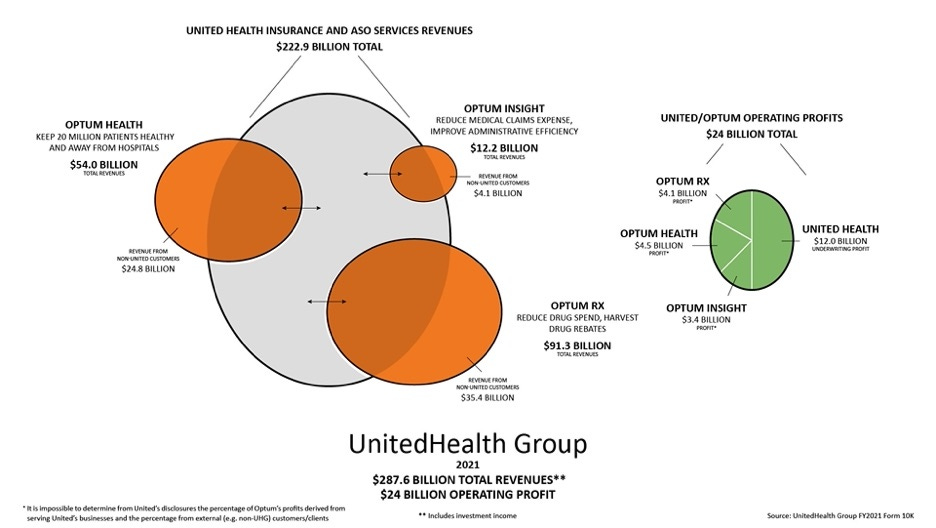

Now, before we have to dive down some awful rabbit hole of how the different parts of the UnitedCaremarkNorth Borg interact with each other, I’m going to take as a premise that even if you don’t believe my argument, please accept the premise: anything that increases cost is good. As promised:

Imagine… a mental health system that would only make costs go up!

Dorothy, you got this:

Basic principles would include:

Everything should require prior authorization—more incoherent roadblocks are better.

The more effective the treatment, the less accessible it must be.

Long wait times are a feature, not a bug.

Financial incentives should drive great doctors away from innovation and insurance panel participation.

The acquisition of endless non-innovation in start-ups keeps founders from being disrupted.

Relentless focus on low acuity.

Diagnostic clarity is to be avoided, both in practice and in the public discourse.

Don’t talk about Fight Club.

Have the prior two rules be borrowed. See what I mean? Non-innovation!

Moving the paradox forward…to profits!

Now, there are constraints on the above system. One could not simply pay for everything that anyone asked for because it would increase the cost of doing business so quickly that they would have unpredictable and massive losses. You need an infrastructure of dynamic approval and denial of claims to perfectly hit the MLR—let’s say the 20% profit margin allowed. Sometimes, you need to deny more claims, and sometimes, you need to deny less. Otherwise, Big Insurance Companies would become too profitable, and by law, they would return those billions. At the beginning of Covid, this nightmare scenario almost occurred – the very expensive care that is most elective healthcare in America got shut off overnight, and in the middle of a pandemic, major insurance companies like United Healthcare ran the risk of having so much more money come in as premiums that they would have to pay it all back. Citing a remarkable exploration of the structure of Optum and United Healthcare:

Hospital finance colleagues reported an immediate and substantial drop in medical claims denials from United and other carriers in the summer and fall of 2020. United’s quarterly profits dutifully and steeply declined in the subsequent two quarters, because its medical expenses sharply rebounded. The rise in United’s medical expenses helped the firm avoid premium rebates to patients required by provisions of the ObamaCare legislation passed in 2010. The firm did voluntarily rebate about $1.5 billion to many of its customers in June, 2020.

This is where the ability to dynamically deny claims or increase the cost for the company by essentially becoming more permissive on what they let through the gate came into play: the IT infrastructure was able to dynamically adjust so that it paid out many, many more claims than it might have otherwise! And now, all of a sudden, the cost of doing business went up so much that all those extra revenues from Covid premiums unspent became strategically spent on the various business lines they own. No real money (less than one month’s profits) had to be returned to the consumer, and shareholders got the expected returns.

Costs have to go up every year, and because multiple companies are in the space, they essentially have to go up somewhat uniformly across all companies. That way, premiums for everybody go up by some semi-palatable amount yearly. You can theoretically comparison-shop between one plan and another but it’s a bit like the best colleges and universities list. It can tilt backward and forwards between Harvard, Princeton, and Yale, but no one has to worry that UMass will knock them out of the running for the top three spots.

I do not believe there is a sinister plot. I believe there is a much more unsettling reality: The incentives driving the balance sheets of our major payers force them inevitably to higher costs, sickness, and premiums. Rinse, repeat, every year, without end, until we are all broke and dead.

In the next section of this epic article, I will review the impact on the mental health system specifically and highlight instances where I suspect the MLR is the most parsimonious explanation for why things aren’t good. We will stress-test the assumptions and look at fascinating/horrible edge cases.

Given the ever-increasing size of our major healthcare conglomerates, we can presume they have mastered the MLR math. Also, Amazon bought One Medical last week, and hot takes from the Twitterati blew the Heck up like a cute girl Twitter account making an inane comment:

Now that we are up to speed…follow as the magic unfolds. With incentives for costs to go up, it will happen!

My argument is that since psychiatric illness is a major driver of general medical spend, we have a mental health system working as intended. The “I’m cutting costs” story is one any health insurance-employed human can tell themselves and enjoy restful sleep at night.1

The payers aren’t—strictly speaking—to blame for perverse incentives (granted, they may have done some lobbying). They are generating shareholder value! Expecting them to lower costs, in violation of their fiduciary role to shareholders, however, is a fever dream. It’s not a broken system, it’s an extraordinary machine. A system “built to spill,2” while maintaining plausible deniability. No CMO or Medical Director is required to be Dr. de Sade.

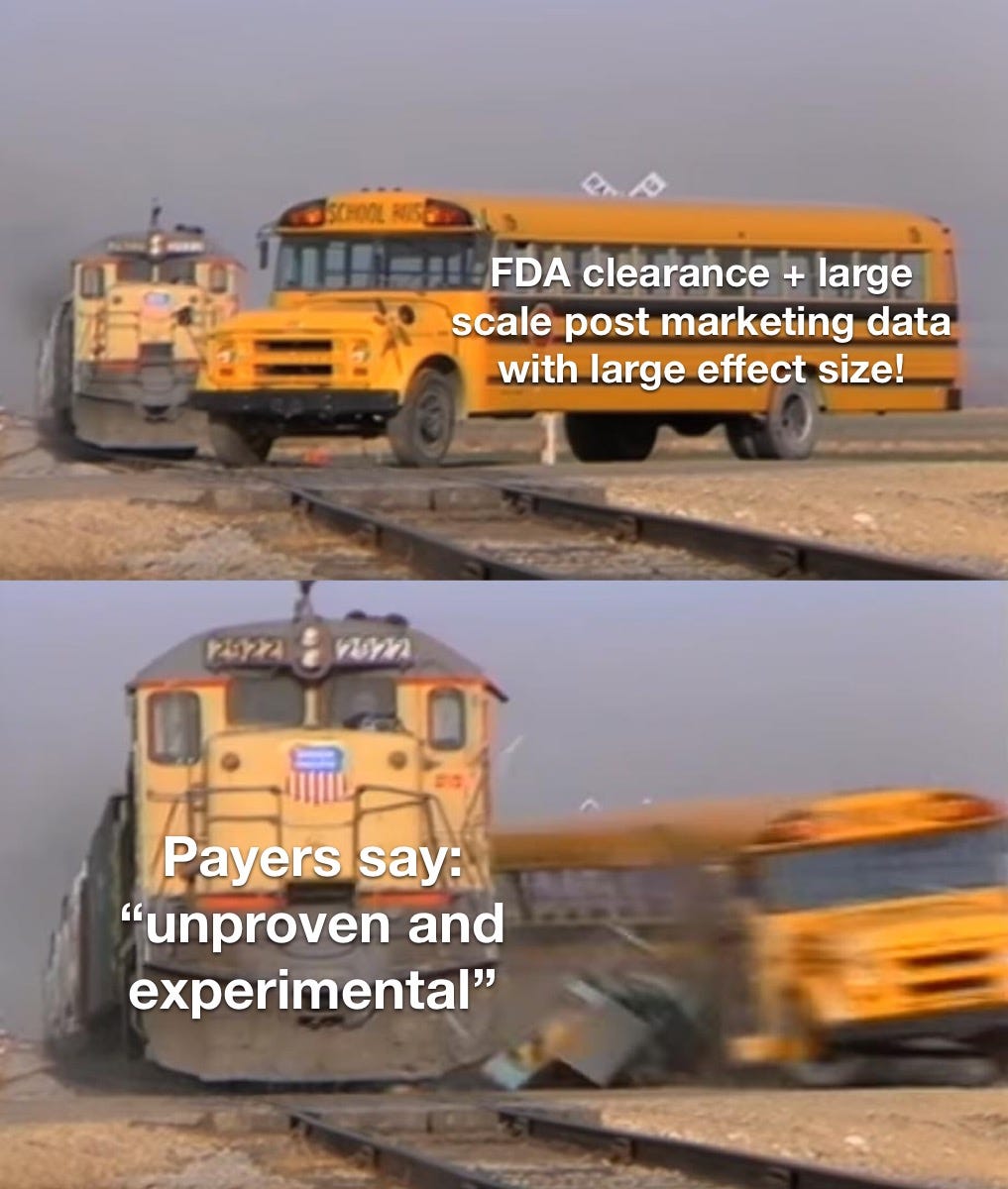

“Unproven”—A 3rd Party Payer Rationale… or an Opening Band at an Emo Show?

“Unproven and Experimental” treatments are excluded from health plans. This can even include FDA-approved treatments (Quoting the FDA website here):

FDA Approval: What it means

FDA approval of a drug means that data on the drug’s effects have been reviewed by CDER, and the drug is determined to provide benefits that outweigh its known and potential risks for the intended population.

Most mental health care is “carved out“ — this means that it is in a separate company silo. No budgets allocated to the care of the brain need to intersect with those allocated to the care of the body- until the quarterly earnings call for the whole company.

Insurance companies seem to love to exclude psychiatric treatments from their coverage. They can’t just do this without any rationale.3. So they develop a plausible rationale. They deny care that is “experimental and unproven.”

The FDA, meanwhile, has this concern as an express part of the approval process for all treatments:

Assessment of benefits and risks from clinical data—FDA reviewers evaluate clinical benefit and risk information submitted by the drug maker, taking into account any uncertainties that may result from imperfect or incomplete data. Generally, the agency expects that the drug maker will submit results from two well-designed clinical trials, to be sure that the findings from the first trial are not the result of chance or bias. In certain cases, especially if the disease is rare and multiple trials may not be feasible, convincing evidence from one clinical trial may be enough. Evidence that the drug will benefit the target population should outweigh any risks and uncertainties.

We who wish to have our patients’ care paid for are asked to pretend, like an insurance reviewer who “wants to hear about the case” before the denial, that the extensive efforts of the FDA should be replicated to satisfy the crack science squad carrying the bag for capricious denials?

Prior Authorization, or, Sisyphus Gets A Gig as a Claims Reviewer After Finding His Last Job Too Fulfilling

The trick comes when we look at the definition of “experimental” or “unproven.” Payers don’t define “unproven” and “experimental,” however. Why should they—with a loose enough definition for those terms, literally everything in medicine can be spun to be experimental and unproven:

Dr. Muir: “the patient has X condition, with a rating scale score in the very severe range. He has previously been treated to remission for X psychiatric condition with Y treatment which is FDA approved. All other treatments have failed. You are now denying this care with Y treatment. [Sup]?”

Dr. Whatshername, Medical Director: “It’s a plan exclusion! We don’t pay for it because it’s unproven and experimental!”

Dr. Muir: “He’s been a plan member for years, and in my prior clinic I was allowed to treat him under the contract we had with you. I know it works for him because your company paid for it. I’m also the co-author of the largest data set of post-marketing results for this FDA approved treatment. Have you reviewed that data?”

Dr Whatshername: “I don’t feel comfortable with this.”

Dr. Muir: “You don’t feel comfortable talking about medical data”?

Dr. Whatshername: “ I feel this isn’t going anywhere. This is disrespectful. It is unproven and experimental.”

Dr. Muir (letting the snark get the best of me): “Please define your understanding of “unproven” for the purposes of this review?”

(The call didn’t last much longer…)4

I imagine Dr. Whatshername, and I could agree this call didn’t need to happen. It was Kabuki of the damned. Neither of us was able to be honest. Dr. W was allowed to say “No.” My options were similarly limited. Perhaps I’d lash out in impotent rage? At best, I would have the Pyrrhic victory of making a colleague feel sh*tty about her life choices. Remember, in the biomedical sciences, we never prove anything. We can demonstrate likelihood. We can replicate those findings. The FDA kinda has this game on lock. However, the fact that we are using statistics means that every “proven” treatment is fair for revision.

Even jury instructions understand that there are shades of certainty: reasonable doubt, for example! Demanding doctors ignore generally accepted evidence is a humiliating immolation of thousands of physician hours. But at least the Payer employed bagmen—sorry, reviewers—get paid for the time spent. Those advocating for care do not5

TRUST ME: A Pivotal Fake Study

Trains Running Unhindered Suck for Those who Might have an Encounter: a Sham Controlled Double-Blind Study.

To be clear, what I’m describing is based on a real study of a treatment for a psychiatric condition, which I have replaced with Getting Hit By a Train. Below is the abstract—a summary of the paper—almost word for word.

Our Experimental Treatment is Brakes.

I need you, dear readers, to consider the following question: Should payers cover this treatment? Or should we consider it unproven and experimental and demand more data?

I present my made-up FDA clearance trial! It’s of bFRT (breaks for runaway trains). Our authors of TRUST ME demonstrate, in those those randomly assigned to be hit by a runaway train, the clinical efficacy of bFRT. (Edits are only for grammar after my find/replace:)

Objective:

Getting Hit By A Train (GHbT), it is a chronic and disabling condition that often responds unsatisfactorily to pharmacological and psychological treatments. Converging evidence suggests dysfunction of “breaks on the runaway train” in GHbT, and a previous feasibility study indicated beneficial effects of breaks for runaway trains (bFRT) targeting the impact at high speeds as a key pathway. The authors examined the therapeutic effect of bFRT in a multicenter double-blind sham-controlled study.

Methods:

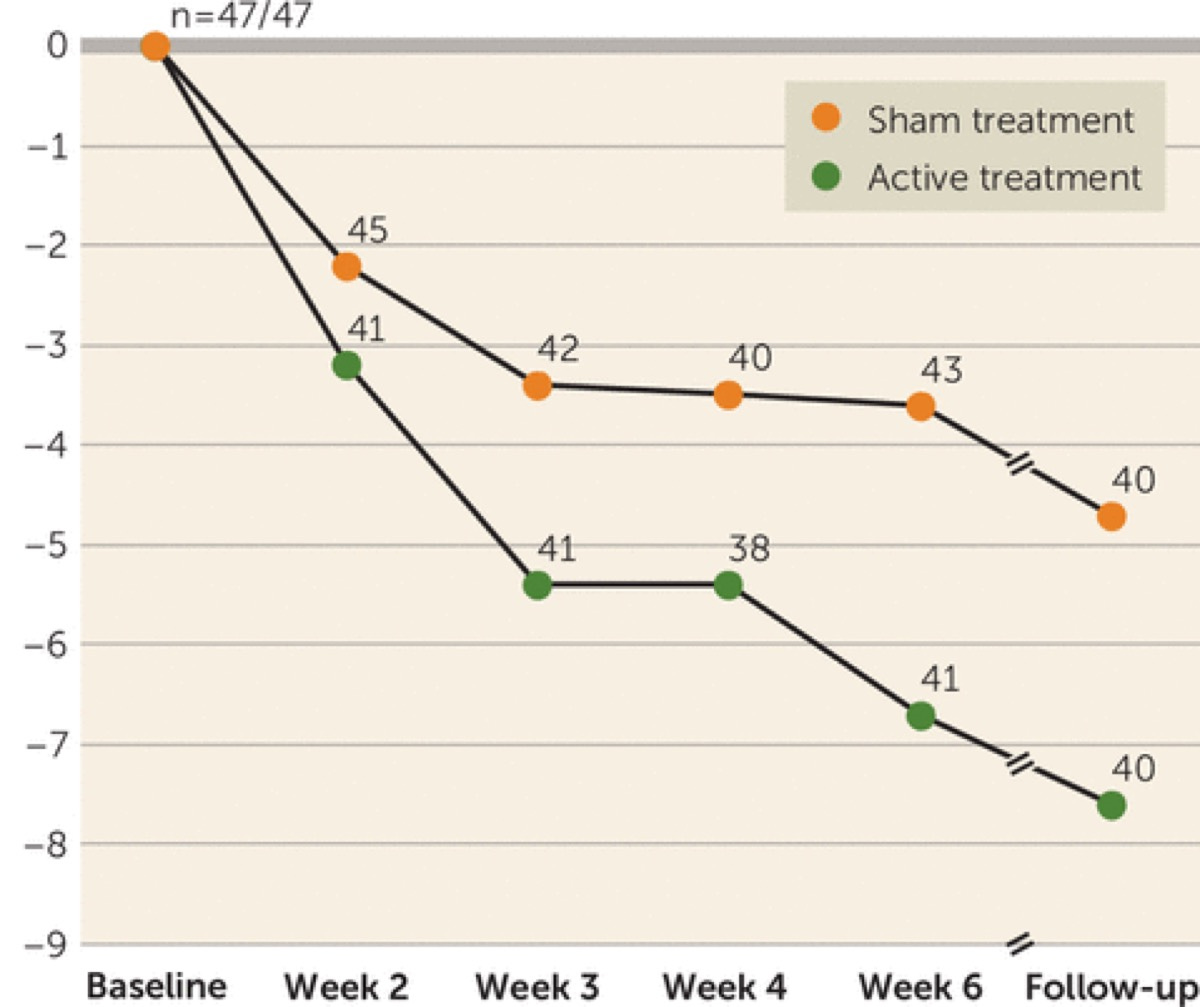

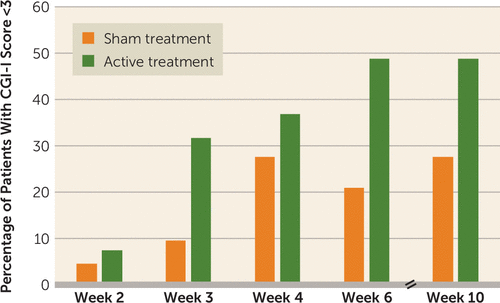

At 11 centers, 99 at-risk-for-GHbT patients were randomly allocated to treatment with either bFRT or sham bFRT (the break lines were cut, but conductors and subjects were blinded to sham vs. active assignment) and received bFRT or sham treatments for six weeks. Clinical response to treatment was determined using the Is Your Skull Fractured Yet Scale (IYSFYS), and the primary efficacy endpoint was the change in score from baseline to post-treatment assessment. Additional measures were response rates (a reduction of ≥30% in IYSFYS score) at the post-treatment assessment and after another month of follow-up.

Results:

Eighty-nine percent of the active treatment group and 96% of the sham treatment group completed the study. The reduction in IYSFYS score among patients who received active bFRT treatment was significantly greater than among patients who received sham treatment (reductions of 6.0 points and 3.3 points, respectively), with response rates of 38.1% and 11.1%, respectively. At the 1-month follow-up, the response rates were 45.2% in the active treatment group and 17.8% in the sham treatment group. Significant differences between the groups were maintained at follow-up.

Conclusions:

High-frequency bFRT improved GHbT symptoms and may be considered a potential intervention for patients who do not respond adequately to pharmacological and psychological interventions.

Summary: 27.4% fewer skulls were bashed in after being hit by a train. This was statistically significant! That is a call to action moment:

Subscribed

The FDA considered TRUST ME compelling evidence of the novel treatment and awarded clearance to the real-world version of bFRT for the psychiatric equivalent of GHbT.

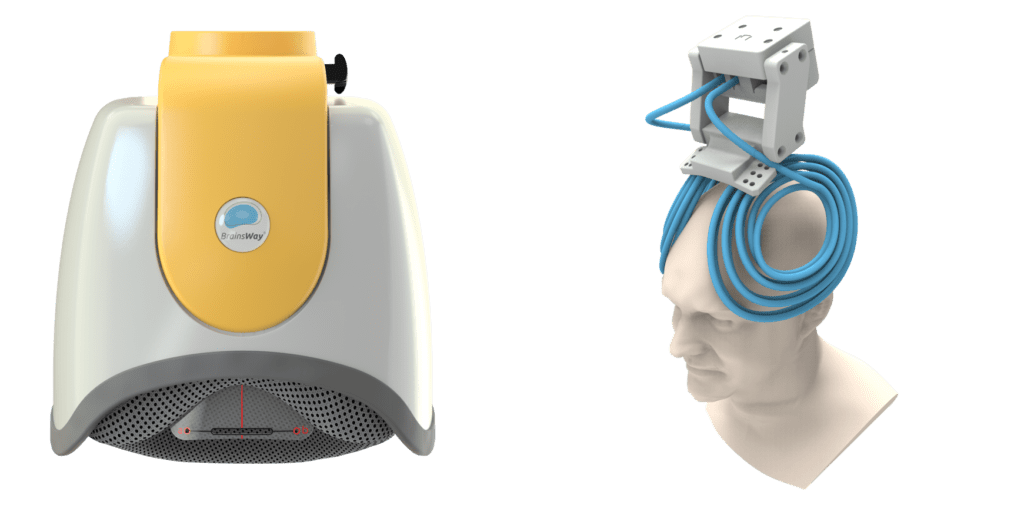

The FDA nod was in August of 2018. I will note that the real-world treatment this satirical study is based on has the same safety profile as brakes on a train—they are both loud, which is about as bad as the risks get. The big reveal? This is a real treatment. It is for OCD. It uses deep Transcranial Magnetic Stimulation (TMS) with the H7 coil made by BrainsWay.

For some reason, it’s absurd to think that we would allow head injuries from trains hitting you. But it’s an acceptable plan exclusion when your own brain is causing tremendous suffering. Even when the Clinical TMS Society has conveniently and professionally outlined when it should be included as a covered service? United Healthcare, along with most major payers, says, “No thanks, we’re good.” At a certain point, Institutional Review Boards will stop studies midway if the active treatment is so much better than the sham treatment that they have to call it early.

It is unethical6 to expose human subjects to sham treatment if it answers no meaningful questions7

History has not been kind to the doctors who exposed human subjects to the dangers of controlled studies8 for trivial or evil questions. The Nuremberg Trials, anyone? It’s like sham-controlled parachute studies for the falling—not ok. 9

It feels a little bit like Dorothy trying to get out of the land of the Wizard of Oz, on hold with a reviewer:

“There is Someplace Like Home, but We Are Afraid You Don’t Meet Three-Heel-Click Criteria at This Time.”

When it comes to attempts to deal with this fiscal minefield, employers have increasingly adopted a strategy of just paying for their own health care, and that’s having more control over their plan design and benefits. This aims to control costs10 while providing better care. This approach is called “self-funding,” and employers that use it hit a perfect 100% Medical Loss Ratio by not profiting from the process. It’s another visit to Golgotha, but crucifixion is no longer mandatory.

My Spirited Dissent…Won’t Matter.

Insisting on non-scientific standards of proof beyond replicated studies with statistically appropriate data sets and even FDA approval or clearance is inhumane.11

If we had more treatments that lead to remission paid for by payers, it would mean less depression, PTSD, OCD, and more. But... Less profits. The key to the profitability of our largest healthcare companies is the ability to control everything:

With all these different businesses, it is theoretically possible for one piece of Optum to be reducing a hospital’s cash flow by denying medical claims for United subscribers, while United’s health insurance network managers bargain aggressively to reduce the hospital’s reimbursement rates while yet another piece of Optum runs the billing and collection services for the same hospital and its employed physicians, while yet another piece of Optum competes with the hospital’s physicians and ambulatory services, diverting patients from its ERs and clinics,reducing the hospital’s revenues.

Damned if we do, and damned if we don’t. However, the infinite refinement of the ability to control the medical loss ratio is the only rational business strategy for our massive health care conglomerates. And who could blame them? It’s a bit like raging against the barbarism of crucifixes but only taking specific issue with the asphyxiation. It was, and is, kind of the point.

“The Fall”: That time we promoted Lucifer to Senior Vice President of Value-Based Suffering at the newly acquired OneHell subsidiary of Heavenly Health:

If the above sounds like a sinister plot to make sure people stay mentally ill, I wish it was. That would be a Sin for which we could beg forgiveness. Satan in charge would have left corporate memos, discoverable emails, incriminating text messages- there would be a paper trail. But you don’t see all the pieces at any given vantage point in healthcare megacorps. It took this long just to explain it. You need to do your job. Everyone is doing a little piece of work in their different silos, and the goal individually is not being fired. Claims are going to be administered. Claims are going to be denied. Prior authorization is going to be required. The machinery of prior authorization will be tinkered with. It’s an invisible maze that is more complicated than whatever the hell Arnold’s Game is using on Westworld. And the suffering is just as gruesome as what the Romans built for systematic crucifixion but with none of the transparency.

Jesus, Etc.

Recall: Jesus had to be killed because he was a dangerous radical and a threat to the financial interests of the day.

Could I get in trouble for writing this? I mean, what are they gonna do, crucify me?

—O. Scott Muir, M.D.

Thanks for reading this Throwback Saturday Article. A week after this article was initially published, TMS for OCD got its first national coverage policy. It is now part of the national coverage policies of more than one major payer. Let’s keep advocating!

Excellent piece highlighting the injustice of our healthcare system! Americans deserve better than to have their quality of life decided by an insurance company instead of by them & their clinician. It's about as absurd a concept as your auto mechanic being unable to change your oil without approval from your car insurance, or being told that it's too soon to have your failing brakes fixed because they are only 95% worn out. The system was forged on the altar of the almighty dollar, and only there can it be unmade.