Never Raise Money For Your Healthcare Startup

An absurdist-ish manifesto

My name is Owen Muir, and I'm a child and adult psychiatrist who cares a lot about Value in Healthcare and who gets upset when things aren't good for patients, who also happen to be humans. I care about value and I care about human values. I make some arguments that do not endear me to the whole world. This will be one of those.

I am not a successful founder of something you've heard of. I am not a particularly successful person. I am a generative person. I write a daily newsletter making fun of successful founder-ship, healthcare companies with explosive growth, and large market cap behemoths.

I literally make fun of actual leviathan and biblical behemoths. Even David? He only picked a fight with Goliath. Goliath would be likely to be a regional manager of an Optum subsidiary.

I don't know if this approach will make me a successful person. I am actually pretty strongly of the belief that being a financially successful person is about luck and a magical belief in secret geniuses. There is data to support this stance: (from Brian Klaas )

A recent research study, involving a collaboration between physicists who model complex systems and an economist.. revealed why billionaires are so often mediocre people masquerading as geniuses. Using computer modeling, they developed a fake society in which there is a realistic distribution of talent among competing agents in the simulation….

What did they find?…

As they put it, “the most successful individuals are not the most talented ones and, on the other hand, the most talented individuals are not the most successful “

This is my proof that I am among the most talented! Which explains why I'm not among the most wealthy, I write defensively. Confirmation bias aside, it has led me to develop the following strategies for ardent founders.

It also, I will admit, creates limits on the kinds of health start ups anyone should attempt. One mismatch between venture investors and venture backed founders is the understanding of what the point of investment is.

Venture investors share some motivations:

Make investments in companies that will return 50 times their investment, or more.

Enough money spare to not cry too much when their investments go to zero, which is the outcome 95+% of the time.

“Adding value”

The only kind of businesses worth investing in, for venture, are successful. Or a catastrophe. There is no role, whatsoever, for somewhat successful businesses. Those are failures.

It is a model based on investing in secret geniuses only.1

Theranos was a great example of a perfectly reasonable company to invest in. Not because it was going to be successful. Because, if it was successful, it would be a massive earthshaking success2. The hidden agenda of venture investors is that they don't want look like idiots to their friends. The are also unlikely to be secret geniuses3.

Being a secret genius is a high-risk activity, financially. It is also emotionally a high risk activity. You have to be an accredited investor, a.k.a. rich enough you don't need to be protected from losing all your money, to invest in a non-public companies like start ups. You can be a completely broke person who's willing to bet your entire future on making a venture investor money, also. There is no risk adjustment for founders.

If you're smart enough to be a founder, you wouldn't be one. It's very risky. If you wouldn't be allowed to invest in your own company, because you don't count as an accredited investor, you're betting 100% of your future on a failure. One that is (almost) certain to fail.4

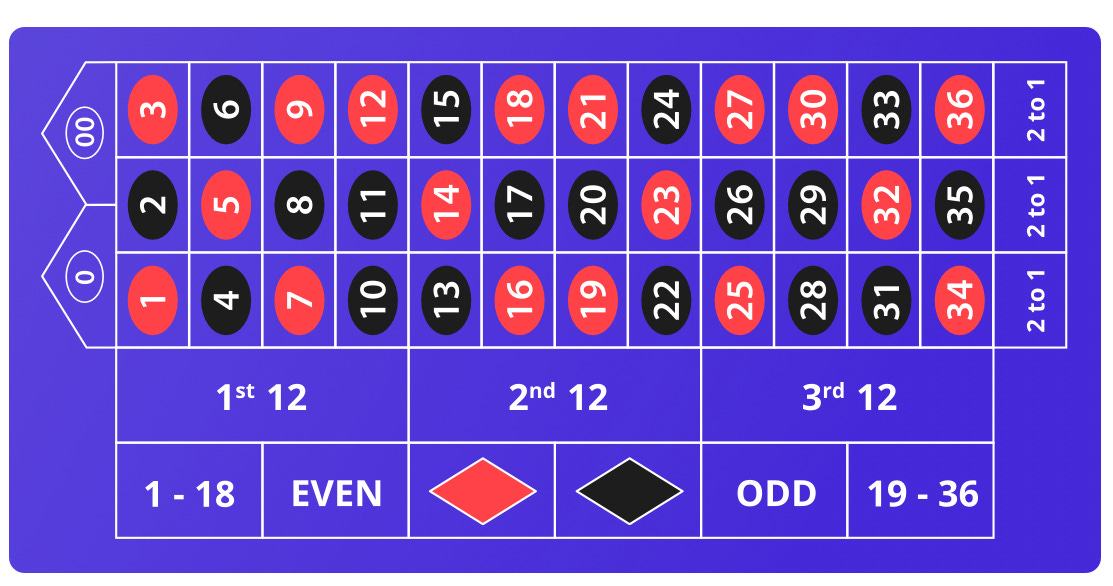

Imagine going to Vegas, and gambling on roulette, but only ever being allowed to put 100% of your chips down on one number.

People don't do this. Most people bet on black. Gamblers hedge their bets. Even a winning roulette bet would be a bad venture backed business outcome:

A bet on a single number pays 35 to 1, including the 0 and 00. Bets on red or black, odd or even pay 1 for 1, or even money.

That is only 35x. —Not good enough.

The odds of winning are 2.70%. This is high for health startups. Unicorns are companies with a valuation of $1b or more.

There are 101 YC Unicorns, ever. There have been 4000+ YC companies. That is a 2.5% unicorn rate, roughly.

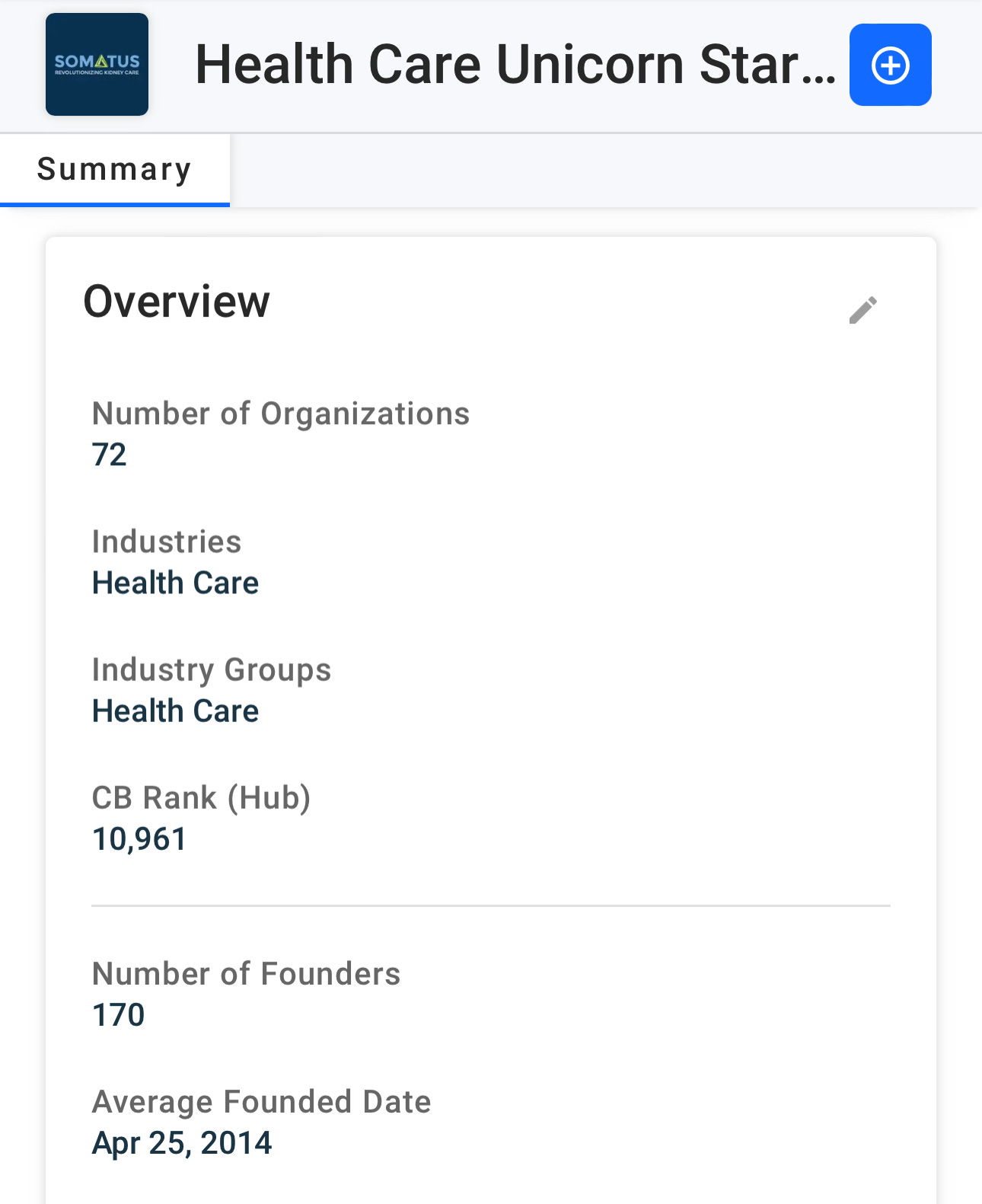

Crunchbase says there are 72 Healthcare Unicorns:

Of accelerators, Y Combinator is the most successful:

Y Combinator is successful at being a better Accelerator for startups, but as a company, it's not putting all the eggs on being one of those start ups. It owns some of all of them. Hedging its bets!

Let’s look at Venture Backed Health unicorns:

Devoted Health:

Valuation: $12.60B (October 2018)

$1,968.95M Raised

6.63x valuation on raised funds

Lyra Health

Valuation: $5.85B (August 2020)

Funding: $906.13M

6.4x valuation on raised funds

Cityblock

Valuation: $5.70B (December 2020)

Funding: $891.30M

6.3x valuation on raised funds

An Fake Company to Make A Real Point

I would like to introduce you to my new investment firm, Corner Bet Partners.

Our hypothesis is simple. We take investment money, from our limited partners, and we make a corner bets in roulette—8:1 payout:

Right in the middle, baby!

Importantly, we tell our limited partners that we are going to invest that money into late stage healthcare companies. But, as you can see above, the multiplier on any given late stage healthcare investment in the most successful health tech unicorns is only around 6:1 payout at best.

As our thesis, placing our limited partners investment at the corner of four numbers on a roulette wheel, we increase the odds of their capital paying off to about 10%, and we increase the return to 8:1. We do this efficiently—without any additional diligence, resources, or other related expenses.5

The other key for Corner Bet Partners? We only ever place winning bets...in keeping with the standards set by the best in the biz.

It is an efficient use of capital with a higher likelihood of success to just put $100 million on number seven on a roulette wheel and give it a spin than it is to invest in a Y Combinator or other health Technology investment. It is literally a safer bet. They payout is capped, however, and it’s not with venture investments. Hedging6 bets? You are a loser of as an investor if your returns are in keeping with any reasonable risk mitigation strategy.7

Doctors, by definition don't place risky bets on untested hypothesis if they can avoid it. This is why we have the Food and Drug Administration, medical licenses, regulation, malpractice, safety standards, the joint commission, and the rest.

Peoples lives! They are at stake. You can't do something risky with peoples lives.

Doctors—even the most reckless— go into medicine, and culture beats recklessness out of us. We are anti-founders. Imagine a startup where nothing could be innovated on without years of regulatory review? You can’t. No traction could be demonstrated.

Now, getting ready for it…I think the solution is for healthcare companies:

Never try to raise money from Venture Capital.

This is good for venture and it's good for Healthcare! Quick:

I'm not even going to bother link to it. There are zero healthcare companies on the list.

Y Combinator—is it the problem? It is an accelerator for start ups that start from zero. So they're willing to give away 7% of their company to YC for the privilege of being told how to do it right. This is the opposite of the right approach to succeed in healthcare.

They are teaching you how to wave your hands and raise money on an idea that can eventually bludgeon in its way into making money for them.

All of the healthcare start ups that reached $1 billion are loser companies. When I say loser, I mean in Healthcare being $1 billion company means you're a tiny fish. UnitedHealthcare is a 1/2 $1 trillion. The Total Addressable market is a $4.6 trillion annual market in the US. If you only become a billion dollars in revenue company, you account for 0.000217% of total US spend.

At a $1b valuation, and a 10x revenue multiplier, if you bring in 100 million a year in revenue, you are simultaneously a Unicorn in startup land, and a Loser in Healthcare:

Here’s $1 billion healthcare unicorns— I’m just giving them away!8

AdverPfiz: Do 1/28th of the advertising for Pfizer. That's it. That is the company.($2.8b annual ad spend)

Medifraud: Defraud Medicaid in NYS: (DiNapoli Finds Over $100 Million in Inappropriate Medicaid Payments)

Epicccccc: Implementation of Epic (Epic’s EMR system costs anything from $1200 to $500,000 to implement the software.)9

Appisolv: Just not being be the horrible app used by most hospitals, as a service. ($100m a year in annual expense)

That is if they are successful. Becoming a venture backed unicorn? This IS failing to build a valuable healthcare company.

Most startups fail. Ironically, failing as a start up and succeeding as a start up in Healthcare look identical from the perspective of big health budgets.

We have entrusted Healthcare innovation to people who mistake failure for success. We should stop. Avoid catastrophe for patients, and because it's a bad investment hypothesis.10

We need a solution.

We need a healthcare innovation framework that doesn't lead to disaster. We also need one that generates real returns for investors.

Rule of the House of Odds:

Stop building theoretically scaleable start ups. These are a terrible investment. If it went through YC, just don't. If it didn't go through YC, the odds are even worse.

In the spirit of the culture of Healthcare, I'm going use the House of God and its classic rules to craft my rules of disruptive and successful-er healthcare businesses.

I. Payers Don’t Pay

II. Payers Demand Pilots That Will Fail

III. In a meeting with an investor, the first metric to check is the value of your time spent providing billable care instead of meeting with this firm.

IV. The investor is the one with the disease.

V. Payment Hacks come first.

VI. There is no healthcare play that can succeed absent a guaranteed government payer

VII. Effect Size + ROI = NTAP payment.

VIII. They can always hurt you more.

IX. The only good contract doesn’t involves a party who can deny payment.

X. If you don't publish an outcome, you can't be a failure.

XI. Show me a Non-Technical Founder who only triples my work and I will kiss his feet.

XII. If the venture investor and the Founder both see a market insight in a pitch deck, there can be no go-to-market there.

XIII. The delivery of value based medical care is to do as much nothing as possible.

The investor is the one with the disease

The reason it makes sense to invest in start ups is not because you want to play a game of roulette—35 to 1 odds? Not good enough.

Going broke in Healthcare means patients get screwed.

That is too risky. The FDA would say to go F- itself, were it their purview.

Investing works because it's a “power law” game. What this means is the returns can be better than roulette, and a tiny fraction of winners is virtually all the returns.

This makes it the wrong money for Healthcare. Going for broke—with patients’ care at stake— is unethical.

So what should we do? Raising money is a terrible idea.

The expectations venture investors have are that they're going to want you to grow fast, and that means you're gonna have a very hard time maintaining the kind of quality that creates sustainable business model.

They will also expect to a burn rate. This means you spend more money than you make. This also means you create a business that fails the second the necessary extra cash dries up.

If you're going to build in Healthcare, it's a little bit like drinking, do so responsibly. That is, by the way, the slogan of booze, encouraging your next shot of tequila.

Healthcare innovators need a plan to be cashflow positive— from the work that they're doing. It is easier to have disciplined spending if you've never had money to burn. This means, for healthcare:

sustainable growth

word-of-mouth

working really hard.

difficult to scale.

And…slightly more difficult to fail.

It also means for the medical tech innovators, looking for innovative practices to partner with, not just sell to. If you have some fancy tech hypothesis, your initial customers are actually developing the product with you.

Maybe you can charge them something, but you should probably pay them in equity also. If they are going to be developing your clinical model, and providing feedback on the product, they are part of your team. They are taking a risk by working with you, and they should be cut in on some of that upside.

We are in it together!

If we play the Health Innovation game together, we manage risk like professional gamblers. There might be a big payout, but it makes sense to spread the risk around by spreading some of the upside among your collaborators, as well as spreading out your risk with shared stakes in your peers.

It means all of us have to raise less money, sell a little less hard, and align incentives, while building build sustainable businesses.

The upside is selling less of of your company to venture or private equity—and never being forced to exist at the expense of our patients.

Stop raising money, start generating cash from valuable work, not just speculation. Our patients will thank you.

—Owen Scott Muir, M.D.

It is vanishingly rare to be a doctor and a secret genius.

when it came to the total addressable market they could win control of.

Not because they aren't brilliant, it is a numbers game. Statistically, those are rare. They are in the business of finding secret geniuses, because the secret is why undervalued and thus profitable.

To choose to be a founder is either to misunderstand what you're doing in the first place, which I think it's actually pretty common, or to be a grandiose Loon. Or, likely, both.

Additionally, all of our hotel rooms and drinks are comped by the casino. So although it is less tax advantaged, the cost of capital is reduced by the relationship with our casino Partners! We are high rollers, and enjoy ourselves.

That what the public stock exchange is for!

Going for broke is the only rational strategy. The chaos we are seeing among health Technology start ups is a feature, not a bug.

a.k.a. these are all companies that would have by definition 100 million in annual revenue, as the only criteria.

To be clear, this isn't building the software product, or maintaining the software product, it's just getting paid to allow epic to get paid for their software product at the regular rates.

Is it possible to improve your odds at roulette?

There is no way to influence roulette odds or reduce the house edge for your chosen game. Having a good grasp of the odds is key, though, when it comes to choosing your bets.

Although there isn’t a solution for how to win roulette on every spin, there are methods you can try to maximize your winnings. For more advanced methods, check out our page on roulette strategy.