The Frontier Psychiatrists is a newsletter written by Owen Muir, M.D. A reader recently asked for a history of healthcare and health insurance in America. I said sure. I have had help on this series from a co-author—my friend Sanjay Shirke. A reader asked for a history of how payment models developed—broadly “health insurance.”

“By increasing the average span of life, medicine has created the problem of care for the aged.”

Dr. Morris Fishbein president, Journal of the American Medical Association. New Years’ Eve, 1934

Chapter 1: Jack and Jill. How Much Does Water Cost?

This is a story of Jack and Jill, a happy, young couple just starting a family—regular folks. Jack works as a waiter. From an actuarial perspective, this is a problematic job regarding the risk of death from opioid overdose.

Jill works as a nurse. This job is noble, but comes with significant risk, including abuse:

Nurses often (56%) experienced verbal or physical abuse from patients, families, and peers, while 42% of nurses felt aggression from persons in a higher level of authority.

They have some odds stacked against their health from the start, it seems! They will likely need good health insurance. Or is it health care? The difference isn’t important, probably. As Hippocrates said, “Let thy food be thy medicine, and thy medicine be thy food.” So, they have that in common, which is nice. Except for nurses specifically, the healthy food is more expensive:

Healthy foods were available for 57% of nurses but were more expensive than other food choices.

One day, their mutual friend, Pat, stops by the restaurant for lunch. Jack is happy to see her - she has a lifelong history of schizophrenia, which has led to a poor employment history1. Sometimes, she has private insurance from her employer. Sometimes, she depends on Emergency Rooms. Jill works nearby in one of those emergency rooms.

Pat is having a good day; she even splurges on a bottle of sparkling water. Pat leaves him a 20% tip. The noise was getting to her, though. Busy day; the place was short-staffed. She remembered working like this, too much! Just when she couldn’t give anymore - a customer saw she was struggling and left her a $50 tip on a $5 tab. She was overjoyed - so now she is generous to Jack, also. She flashes back to her difficult day - at the end of which she lost her job. That led to months of a downward spiral. Just thinking about it now…she begins hearing voices again. This is common on a population level—7.3% of people will experience auditory hallucinations.2

Jack’s restaurant is busy that day, and she starts to hyperventilate. She never gets around to drinking the seltzer. She faints! Jack doesn’t know what to do - someone calls 911. After a long 10 min, the paramedic arrives; Pat comes to, settles down, and gets into the ambulance.

In the E.R., Pat is distressed but not agitated. Jill checks Pat’s vital signs. She orders an I.V. saline drip for dehydration. After oral rehydration drink and some routine bloodwork, Pat awaits a psychiatrist to evaluate her symptoms. She has a history of schizophrenia so they can’t leave anything to chance.

What’s the Tab for the Water?

The restaurant and the hospital make money by charging a markup on the goods (water) and the systems to provide the water. Jack pushed water with a little carbonation for $8 plus tip - so it’s marked up 500%. Jill pushed an I.V. of Normal Saline. It is sterile water with a pinch of salt. Jill would have a hard time knowing the cost of that water, but $1 of saline can be billed for $1000 - marked up 15,000%.

We Need to Bill for That Bill

Before we pay for water, we have to pay for the intellectual property to describe the water we will pay for. Current Procedural Terminology (CPT) codes are a registered trademark of the American Medical Association. It’s been granted a monopoly by CMS as the way the government will pay for care:

In 1983, the federal government stipulated that it would be the sole system used to reimburse providers under Medicare and Medicaid.

The amount of money the AMA brings in from CPT codes is not disclosed. However:

The AMA does not disclose the revenue it generates from CPT code book sales and related royalties, but a 2001 estimate put the total at $71 million a year.

CPT codes describe both medical services—a physician evaluating how much water is needed, for example, and there are specific codes to reimburse for the bag of water itself.

That’s because payment healthcare is what we call fee for service. Doctors can try to figure it out themselves, or they need professional Medical Coders who slice the actions of a professional into a series of diagnostic codes associated with a “Current Procedural Terminology” or CPT Code. Did your doctor talk about “Smoking Cessation” for 3 minutes? That’s CPT code 99406, and it’s billable for about $12 at 100% of medicare rates.

CPT codes are a Registered Trademark of the American Medical Association, and the AMA charges licensing fees for their use… and sells books on how to code. There are classes on how to code, which also pay them for the privilege….now imagine if Jack’s restaurant had to pay a licensing fee for the term “Grilled Chicken Sandwich, and again to list the menu in “dollars” and the waiters all needed to be certified to tell you about the sandwich by law.

The roots of modern CPT codes were introduced in the 80s—the 1880s. A school of thought known as “Scientific Management” analyzed manual processes, especially in the automobile industry. Through “time and motion studies,” standardized “Best Practices” were defined that transformed the work of skilled craftsmen into assembly line workers.

Workers hated it. These proud craftsmen were very frustrated by the dumbing down of their work. When Henry Ford turned skilled metal workers into unskilled shop workers, their annual turnover rate was 370%, meaning you had to hire about 4 people to get one year’s productivity. Ford famously solved the problem of burnout and turnover by allowing workers to double their wages by hitting certain productivity goals. Many of his workers were happy to do more productive work for more pay.

But in this case, healthcare workers bear the costs (and misery) - designed and owned by their guild—and pay dues for the privilege—of the American Medical Association. The UAW unionized, and doctors are doing the same as I write this. Ford had to double wages to stave off revolt.

Neither high turnover of health care personnel nor doubling their wages is a great look for a country with triple the number of elderly people in 2060, but it’s a splash in the pan compared to the graft in the system.

If you want to print CPT codes on novelty T-shirts or toilet paper, you need to contact the AMA’s CPT Intellectual Property Services; you can apply at ama-assn.org/go/cpt. But beware! “The AMA disclaims responsibility for any errors in CPT that may arise as a result of CPT being used in conjunction with any software and/or hardware system that is not Year 2000 compliant.” Caveat emptor.

Relative Value Units (RVUs)

Those CPT codes don’t determine reimbursement for healthcare workers’ efforts. Medicare and Medicaid didn’t want to pay the licensing fee all over again. So they did the obvious thing and invented a whole different set of codes. The Medicaid codes are HCPS codes. These back-solve to RVUs, also. Imagine printing a new phone book because you didn’t want to pay a fee to the Yellow Pages. And the codes don’t have any fancy algorithms— it’s one CPT code for one RVU calculation. We track CPT codes when you do a patient visit, but to actually get paid, those codes have to be translated into RVUs, or relative value units. The AMA has meetings where they assign RVUs to CPT codes. The CPT codes stay the same…but the relationship between code and payment is another level of abstraction away and varies year by year, specialty by specialty, locality by locality.

Relative value units model how much physician time is entailed in any medical procedure. Simplish. Then there are the Practice Expense RVUs, fixed costs to Keep The Lights On, so to speak, and pay for the variable expense of being a neurosurgeon vs being a psychiatrist on average. Separate from that is a Malpractice Expense RVU—this factor to the reimbursement on a given CPT code includes how often you get sued and what you have to pay for the insurance to practice as any sub-specialist, again, on average. Lastly, you have to figure out which of the 72 Geographical zones recognized by CMS your bill will be submitted in for your practice location.

Then, those RVUs are calculated into dollars using this similar formula:

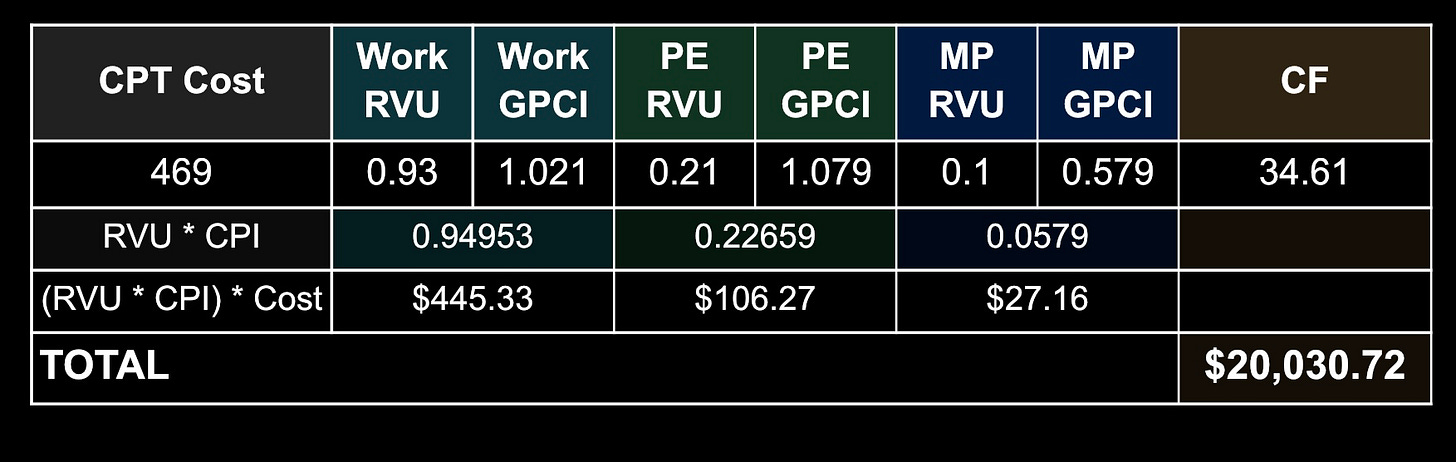

[(work RVU x work GPCI) + (PE RVU x PE GPCI) + (MP RVU x MP GPCI)] x CF = final payment

Back at the restaurant, it’s as if Jack is allotted a set number of minutes to pour the bottled water. That’s fudged by factoring in combination with the expense of running the restaurant and the insurance cost based on his type of restaurant’s risk of injury from pouring the bottled water (malpractice). Each of these three factors is adjusted by the “Geographic Practice Cost Index,” or GPCI, based on the cost of living in about 72 areas in the U.S. Finally, multiply that by a “conversion factor” that floats with inflation.

So what is that in dollars???

Pat got a “Level II ED Exam, CPT 99282, " for the low price of $469. The Work RVU is 0.93, the Practice Expense RVU is 0.21, and the Malpractice RVU is 0.10, for a total RVU of 1.24. This happened in “REST OF CALIFORNIA,” meaning not one of the 31 OTHER Geographic regions in the state, So the RVUs are 1.021 for Work, 1.079 for Practice Expense, and 0.579 for Malpractice Insurance. Finally, the Conversion Factor for 2022 is 34.61

So for the visit -- just for being evaluated before treatment, the billing is:

For medical services, we have a CPT code—plus a little licensing fee to AMA—and each CPT code represents a certain number of relative value units or RVUs. This proprietary system turns RVUs (and the conversion factors above) into a submittable bill. 99205 is the “initial code for an evaluation and management service rendered by a physician, nurse practitioner or physician's assistant, initial encounter.” But in the outpatient setting, not a hospital. Or emergency room. Or urgent care clinic. Or…you get the point.

Is the CPT code wrong? Miss a modifier to add another CPT code successfully to the tab? Leave one out? Well, then, the hospital or outpatient practice doesn’t get paid. The system's complexity creates endless confusion. Medical Coder Consulting has become an entire profession to help healthcare professionals review their billing and care strategies to collect revenue from office visits. My readers will be shocked to learn that healthcare concerns hire lobbyists to create new CPT codes for their use—I have done such advocacy! If there is no code to describe what you do on your rate card, you might as well not bother.

So, all that aside, her insurance company will get billed $20,030.72 for the visit, right?

Well, no. Of COURSE not...

More to come! Thank you to my co-author Sanjay… and my reader— for the request!

Marwaha S, Johnson S. Schizophrenia and employment - a review. Soc Psychiatry Psychiatr Epidemiol. 2004 May;39(5):337-49. doi: 10.1007/s00127-004-0762-4. PMID: 15133589.

Kråkvik B, Larøi F, Kalhovde AM, Hugdahl K, Kompus K, Salvesen Ø, Stiles TC, Vedul-Kjelsås E. Prevalence of auditory verbal hallucinations in a general population: A group comparison study. Scand J Psychol. 2015 Oct;56(5):508-15. doi: 10.1111/sjop.12236. Epub 2015 Jun 16. PMID: 26079977; PMCID: PMC4744794.

Sheesh. This probably crosses the threshold of the absurd.