What the Heck is Happening at UnitedHealth Group?

Massive layoffs at Optum, Change Healthcare Attack, DOJ Probes, Insider Shares Dumped...and a surging share price?

The Frontier Psychiatrists tries to, when not carefully dissecting research articles for my adoring science interpretation fan base, provide ongoing coverage of big happenings in healthcare. Honestly, it seems something is up at United…this column asks a question…why did executives sell $105m in shares prior to the when the DOJ probe was revealed?

Here are the pieces that don’t make sense to me: UnitedHealth Group is, contra the claims of its CEO, unimaginably huge:

For those who aren’t obsessed with the details of Employment Law, there is a federal law called the WARN Act:

The Worker Adjustment and Retraining Notification (WARN) Act helps ensure advance notice in cases of qualified plant closings and mass layoffs. The U.S. Department of Labor has compliance assistance materials to help workers and employers understand their rights and responsibilities under the provisions of WARN.

It mandates employers who are engaged in “mass layoffs” comply with the law, including:

The WARN Act requires employers to provide written notice at least 60 cal- endar days in advance of covered plant closings and mass layoffs (see glos- sary). An employer’s notice assures that assistance can be provided to affected workers, their families, and the appropriate communities through the State Rapid Response Dislocated Worker Unit (see glossary). The advance notice allows workers and their families transition time to seek alternative jobs or enter skills training programs.

This applies to companies like Optum thusly:

A WARN notice is required when a business with 100 or more full-time workers (not counting workers who have less than 6 months on the job and workers who work fewer than 20 hours per week) is laying off at least 50 people at a single site of employment (see glossary and FAQs) or employs 100 or more workers who work at least a combined 4,000 hours per week and is a private for-profit business, private non-profit organization, or quasi-public entity separately organized from regular government.

And, for what it’s worth, UHC has already been sued for non-adherence with this law:

UnitedHealth Group and Optum violated state and federal employee notification laws during mass layoffs that occurred earlier this year, two former employees allege in a lawsuit filed Oct. 30 in a California federal court.

The two plaintiffs are California residents and claim UnitedHealth violated the WARN Act when it laid off more than 1,000 employees nationwide in August, including 700 in California, without proper notice. …

"Without informing terminated employees and members of the plaintiff class of their WARN Act rights to 60 days of notice or pay in lieu of notice, UnitedHealth solicited releases from the former employees, which provide less wages for many than the WARN Act notice requirements mandate," the plaintiffs' attorneys wrote. "In essence, members of the plaintiff class have been fraudulently induced to accept severance pay packages that provide less than 60 days of wages.

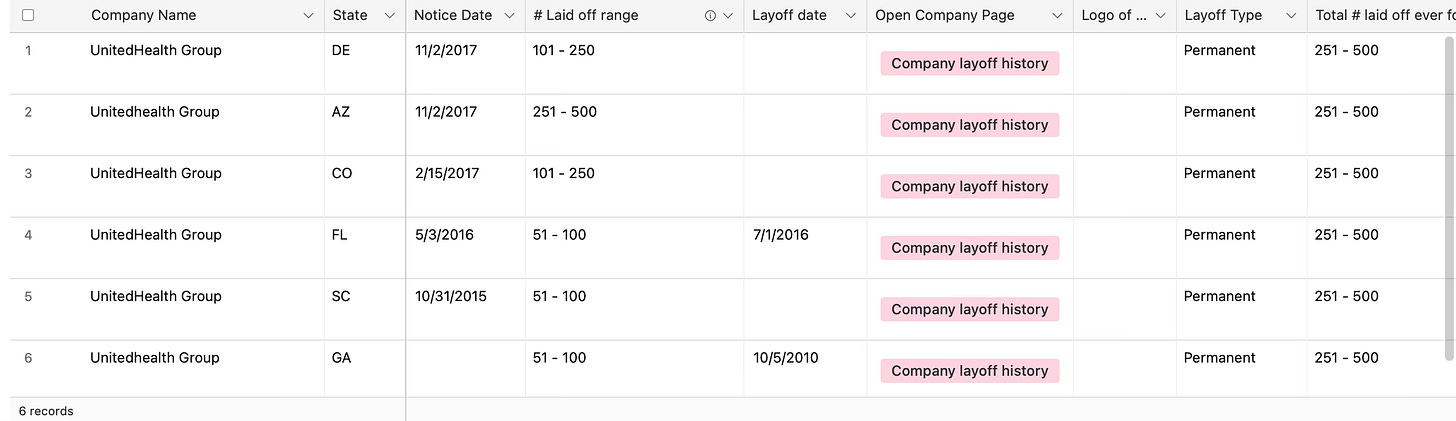

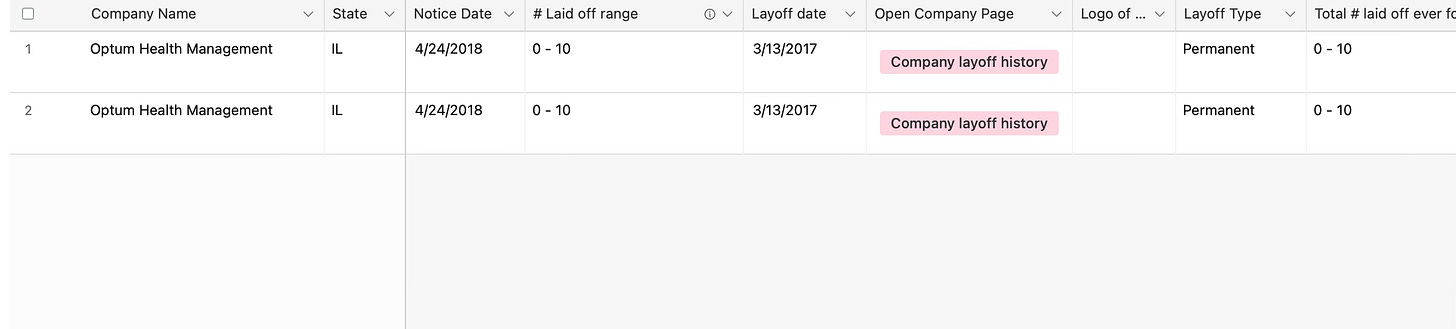

That was in 2023…before the last few weeks. And before yesterday. Even casual inspection of the internet will reveal UnitedHealth Group might have laid off whoever was supposed to submit layoffs to WARN in something like 2017?

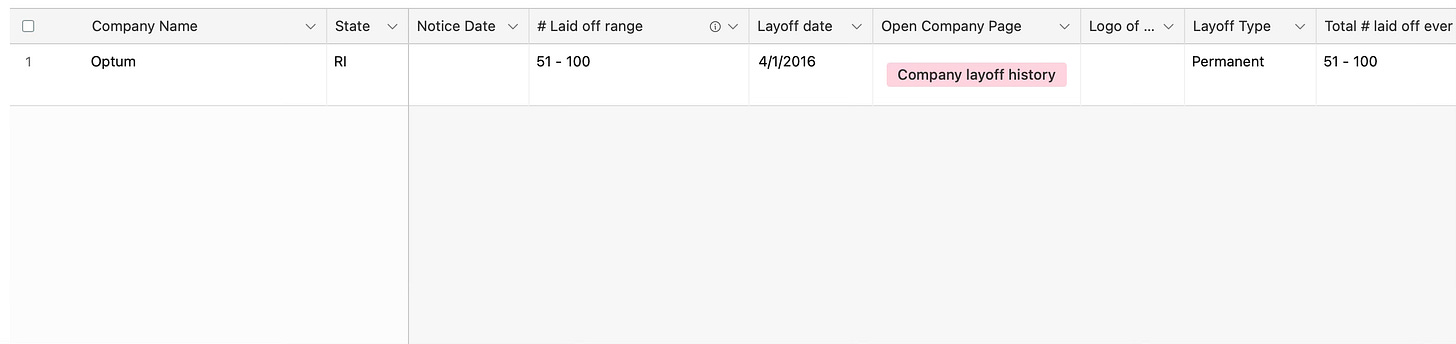

And since this one company is really hundreds of companies, if not thousands, the individual non-obvious searches one could do are similarly non-illustrative:

a cherry on top:

Keep in mind— there was no legal mandate to report 10 layoffs— but they almost certainly haven't reported whatever went down yesterday.

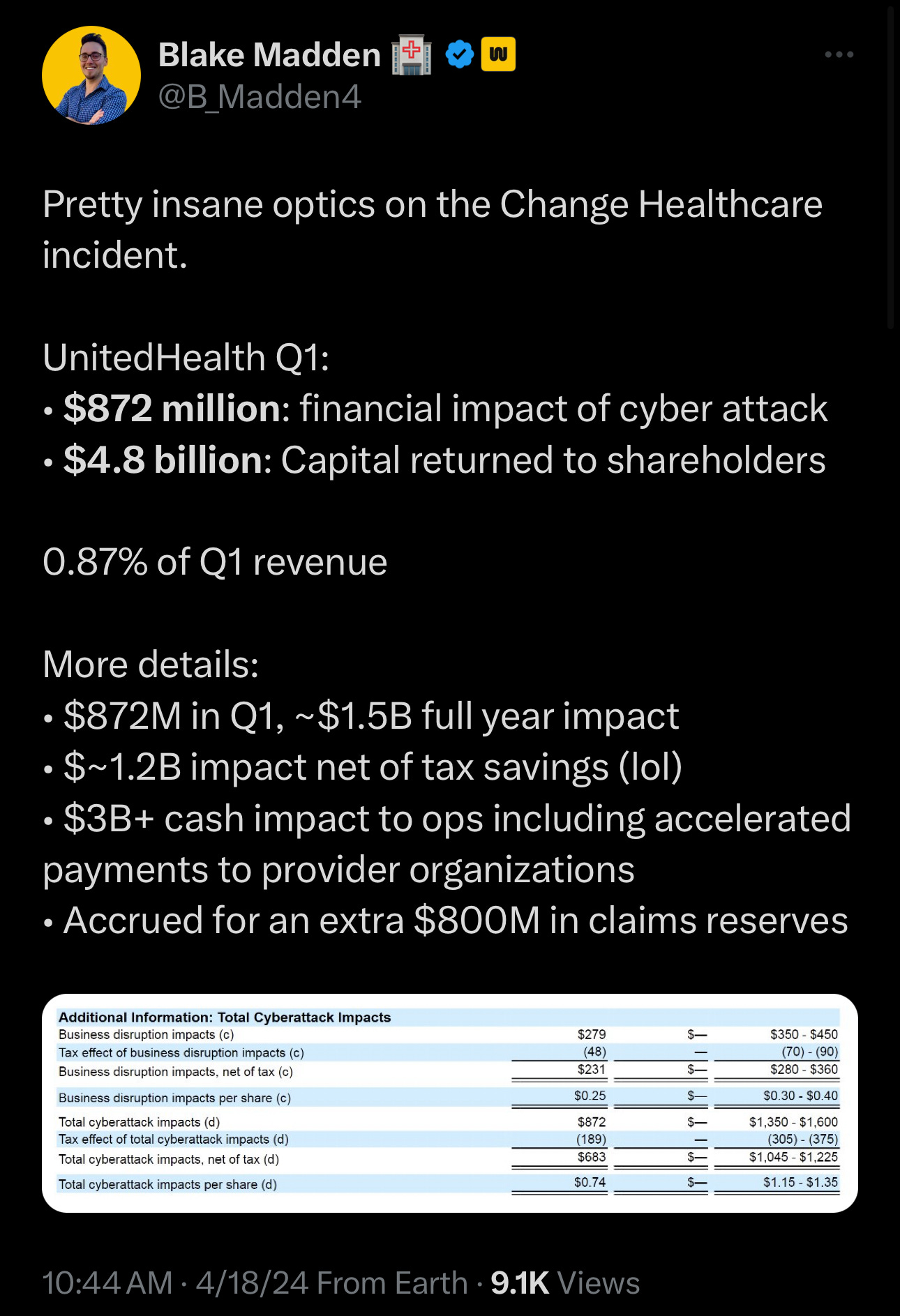

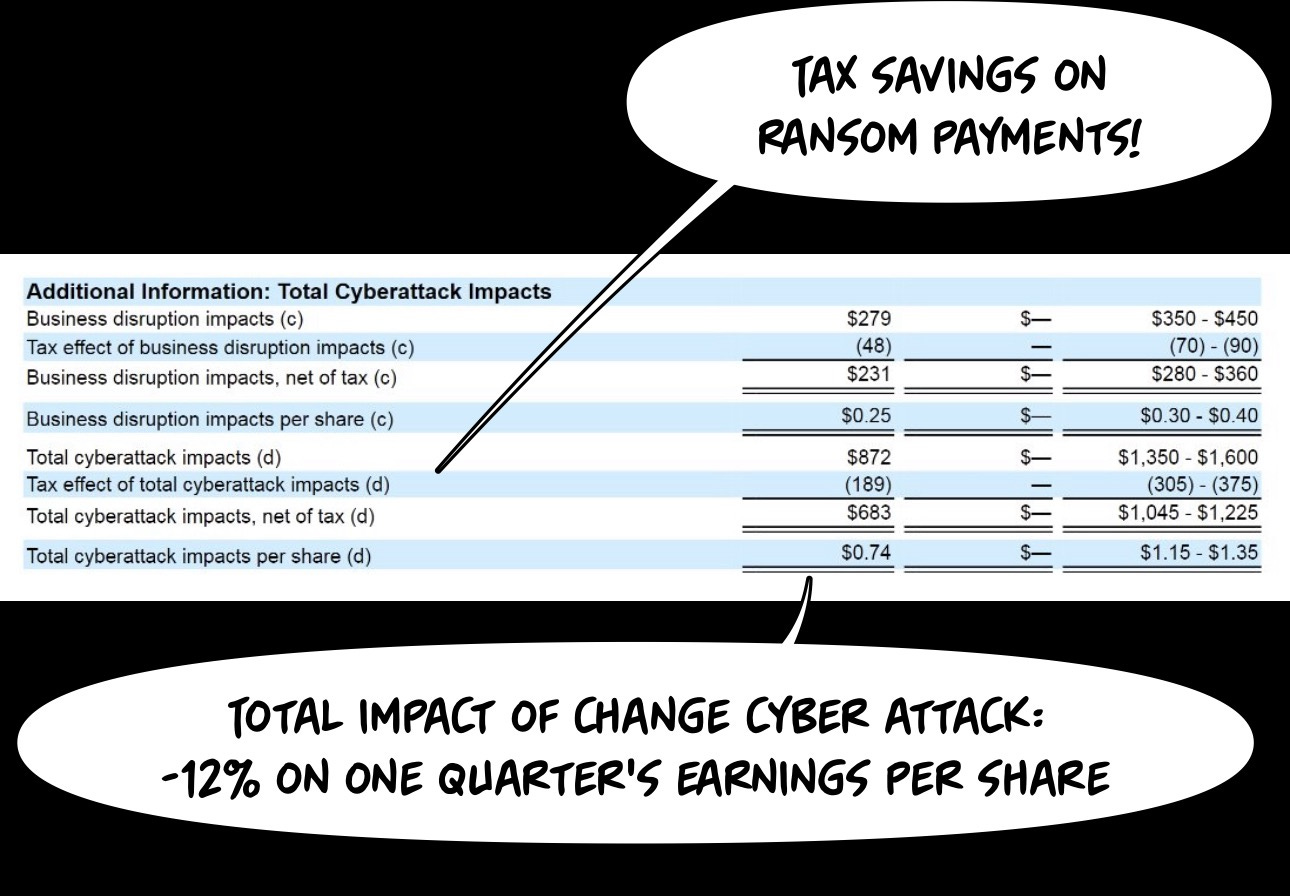

Big companies companies lay people off. United doesn’t feel the need to comply with the law because they pay so much to political campaigns regulators are leashed in their enforcement “bite.” The revenues are so much that not even a massive cyber attack matters financially to UHC.

Blake Madden:

…zooming in…

But according to media, the share price is doing just fine…

UnitedHealth stock is now up 12.3% on the week. It down 0.2% in April, after a two-week sell off following news that Medicare Advantage reimbursement rates for 2025 would not be increased from initial estimates established in January.

On Tuesday, UnitedHealth reported better-than-expected earnings and revenue with EPS rising 10.4% to $6.91 while sales grew 8.6% to $99.796 billion. UNH shares jumped more than 5% Tuesday even though the results exclude the bulk of costs the company incurred to shore up operations and support affected medical care providers after February's cyberattack on its Change Healthcare unit.

So it's a little bit unclear why massive layoffs make sense? Other than it being a great business decision according to someone:

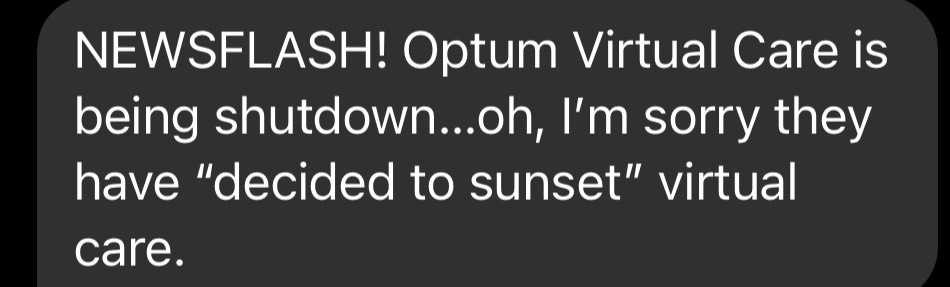

Still trying to confirm that report; but i’m getting data from Cold Outreach on TikTok…Facebook and other sources from insiders…

And subsequently, my source continues:

this "sunset" crap is a cluster!! They refuse to notify patients...we are all telling our patients of course. Still accepting new patients (emphasis mine)

They sent us each a list of open jobs within the corporation to see if any of them are a fit. None of them are actually "open jobs" | I checked every single one on the Excel spreadsheet

Keep in mind, Optum employs roughly 10% of physicians in America. Massive layoffs make sense—the share price goes up. Check. Change cyber attack? Virtually no impact. DOJ investigation? What else is new?!

None of this makes makes the sale of shares by senior leadership make sense…Becker’s:

Bloomberg reported April 11 that UnitedHealth Group's chairman and three of the company's executives made a combined $101.5 million from stock sales made over a four-month period leading up to the public becoming aware of a Justice Department antitrust investigation.

The stock sales occurred between Oct. 16 — the week after the company reportedly received notice of the Justice Department's investigation — and Feb. 26, the day Bloomberg, The Wall Street Journal and other outlets reported on the investigation, according to the report. Shares fell 5.2% in two trading sessions on Feb. 27 and 28 after the investigation was widely reported.

Which brings me to my point…what if the DOJ probe wasn’t why the executives dumped shares? Maybe there is another, worse reason? What is something is really actually rotten in the state of Denmark that we still don't know about?

With UHC we’re never going to know the entirety of what is or has been rotten.