The Medical Loss Ratio

The history of health care payments, part III

Welcome to The Frontier Psychiatrists. Today’s post is a collab with my friend, Sanjay Shirke . It’s another banger— when it comes to medical economics. I’ll remind my readers I have a book for their enjoyment on the beach (with a Kindle for the time being): Inessential Pharmacology. (Amazon Affiliate Link).

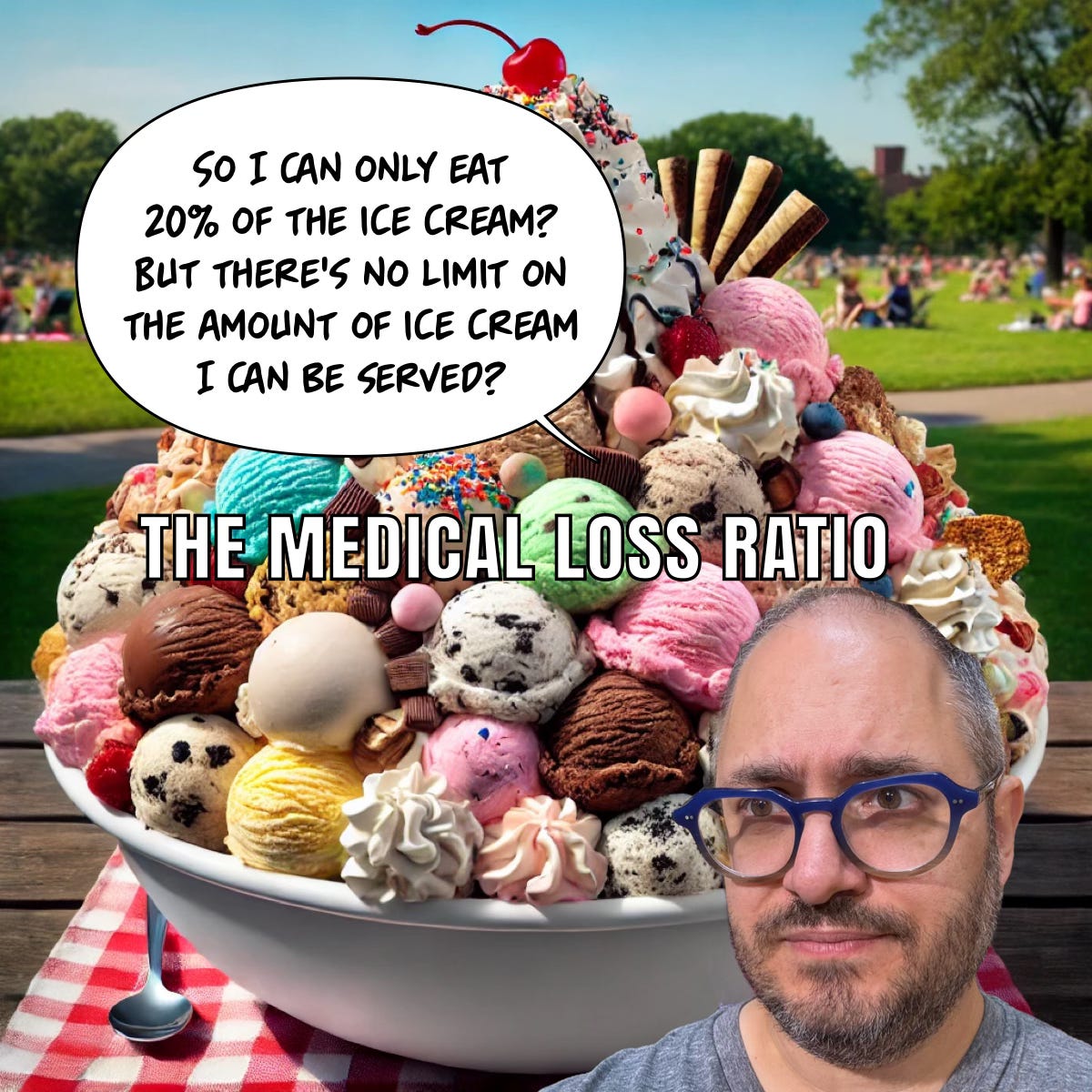

The Affordable Care Act aimed to restrict health insurance profits by specifying that insurance companies couldn't be greedy. They defined this by mandating that a fixed percentage—usually 80% of the premiums collected—be spent on providing health care.

The idea was to prevent “obscene profits.” The company can keep no more than 20% of premiums collected — that sounds good, right? Only problem? For-profit companies have a fiduciary responsibility to make more money for their shareholders. So the CMO goes to the CFO and says, “Dude, the most we can make is 20¢ per $1 now; the party’s over”. You could save money through preventative ways to keep your patients healthier. Go forth, provide the care you're contracted to provide more efficiently and keep optimizing until you’ve earned your 20¢ on the dollar. Do well by doing good. But if you earn the same amount this year that you earned last year, your benevolent overlords on Wall Street will be displeased.

So…no, no, no! With a tip of the hat to the great SNL sketch about First Citiwide Bank (a bank that only makes change and somehow makes it up in “volume”): if the profit margin is limited? If the “20%” is held constant, you have to increase the total number of “$1s”. By inflating the cost of your services from one dollar to two, the 20% is now 40¢. Those, in case you missed the point, are profits.

Yes, that's correct. Big Health can increase profits only by increasing costs. The truth is costs have to go up or their profits go down, and they can't make their profits go down and keep their job. Now, all you have to do is make sure that enough expensive procedures are carried out. If people start getting cheaper procedures and the cost of care goes down, you could end the year by spending less than 80% of your premiums, which means that you have to refund money to your customers.

There’s a paradox. Their brand is saving money. Would CFOs feel great about insurance companies saying, “We're here to guarantee costs go up”?! What they need is to stand staunchly against expenses…while routinely failing. Denials of care? Those are the plausible deniability for Big Health. Can you say you're doing that? Not while you look yourself in the mirror in the morning. Plus, the narrative for insurance employees is to let them get out of bed in the morning to control costs. That's a reason that makes sense…if, like most people, you don't understand the business model.

There are some populations in which one could control costs—“dual eligibles,” for example. These are individuals who qualify for Medicare disability and have Medicaid as secondary insurance because they are disabled and impoverished. Only taxpayer money is spent on these populations, and fewer losses are better; thus, the incentives align to save money.

The incentives, with a fixed medical loss ratio, are all wrong for a traditional insurance company. Insurance, and every other field of endeavor, makes money by accurately assessing the risk they're going to pay out and then selling policies for more than they're likely to pay out. And then the risk of buying an insurance policy based on their insurance policies. This is called reinsurance. Big Health insurance companies get reinsurance on their insurance policies. There's also a type of insurance called Stop-Loss insurance, which is essentially the FEMA of health insurance secondary insurance policies. But traditional insurance has to make more money in premiums than it pays out. That's the business model. If you can pay out nothing and you are taking a bunch of premiums, you're winning. There is no mandate for homeowners insurance to pay out 80% of the premiums—they can control costs and be even more profitable. The Medical Loss Ratio mandate gets it all wrong for healthcare.

Health insurance companies have to follow the rules of traditional companies and public markets, so they have to increase shareholder value. At the same time, paying for human healthcare gives them a perverse incentive to keep spending more on that thing to keep increasing their profits. It’s not just “bad people” or “bad companies” leading to bad outcomes.

Frankly, my opinion is that some heroic people take jobs in these industries—quixotic temperaments and high frustration tolerance are rewarded personality features. There are complex and detail-oriented gigs, and a lot of good might be done. The incentives, however, make it hard to do the right thing and return the kind of shareholder value you would in another industry where driving down cost was rational.

Even BEFORE the Affordable Care Act, the HMOs and Managed Care Plans were teaching psychotherapists how to get rid of patients in order to get their "bonus." I had a friend who left the psychotherapist in tears because the woman was so rude and condescending, and essentially engaged in torture therapy!🙃